|

|

| |

|

SEPTEMBER 2014

|

Property Fraud: Buyers, Bondholders Beware

|

|

“Our system of deeds registration is negative: it does not guarantee the title that appears in the deeds register” (extract from first judgment below)

Although in practice title deeds as registered in the Deeds Office are accepted as proof positive of property ownership, two important SCA (Supreme Court of Appeal) decisions illustrate a little-known but potentially serious danger here.

Case 1: Forgery most foul

The facts of the first case were these –

- A property owner died a week after (apparently) signing an agreement selling her property to a company controlled by her two sons

- A bank thereafter registered a bond over the property to secure a R6m loan to the company

- The company was liquidated

- It came to light that one of the sons had forged the mother’s signature on the sale agreement, and had also forged his brother’s signature on a “consent to sale”

- The executors of the mother’s deceased estate, wanting naturally to set aside the transfer and get the property back into the estate, approached the High Court for assistance. The Court ordered the Registrar of Deeds to transfer the property back to the deceased estate, and to cancel the bond – presumably leaving the bondholder down R6m.

Confirming this order on appeal, the SCA commented that “….. where registration of a transfer of immovable property is effected pursuant to fraud or a forged document ownership of the property does not pass to the person in whose name the property is registered after the purported transfer”. Where there is no “genuine intention to transfer ownership” on the part of the seller, ownership does not pass and registration in the Deeds Office has no effect.

Case 2: Fraud even fouler

The second SCA case involved a homeowner whose inability to pay her bond instalments led to the bank attaching her house. Desperate to raise a loan, she approached a property investment company whose agent fraudulently tricked her into signing sale and leaseback agreements – she thought she was signing paperwork to raise a loan.

Confirming that where a sale agreement “….. is tainted by fraud, ownership will not pass despite registration of transfer”, the SCA upheld a High Court order for reregistration of the house into her name.

The bottom line – be careful!

Both buyers and bondholders are at risk here, and need to investigate thoroughly at the slightest hint of anything amiss in a property transaction – taking Deeds Office records at face value isn’t always as safe as it seems.

And the danger of fraudulent transfers taking place seems to be particularly high at the moment, with media reports of high level investigations into alleged fraud, corruption and maladministration in our Deeds Office system.

|

|

Business Rescue And Suretyships: Creditors At Risk

|

Consider this scenario. It’s unfortunately one all too likely to face creditors in these hard times -

- One of your corporate customers runs up a substantial debt, finds itself in financial distress, and applies for business rescue

- You suspect that somewhere down the line you will have to write off at least part of your claim

- Sure enough, a business rescue plan is proposed that will in effect compromise your claim

- Nevertheless you are relaxed, because you hold personal suretyships from the directors and they have assets. They are good for the shortfall if necessary.

But before you relax too much …..

The outcome of a series of recent court decisions is that your suretyships could well become worthless if your main claim is compromised in an adopted business rescue plan (it normally is).

In the most recent case, the High Court held that –

-

Before adoption of a business rescue plan you can still sue the sureties - the moratorium against suing a company, which kicks in as soon as business protection proceedings commence, gives no protection to sureties.

-

However, if a business rescue plan providing for compromise in full and final settlement of your main claim is adopted by a meeting of stakeholders, your claim against the sureties also falls away unless –

-

Your suretyship document is correctly worded to preserve the suretyship claim, or

-

The business rescue plan validly provides for the suretyships to survive.

- It doesn’t matter if or how you vote at the meeting to consider the business rescue plan - you are bound by the meeting’s decision.

Preserving your suretyship claims – a checklist

- Before you grant credit in the first place –

- Have your lawyer check your standard suretyship forms – are they correctly worded?

- Take advice on replacing them with full guarantees from directors (as some commentators are suggesting).

- Look also for security other than just the suretyships – cessions of debtors, bonds over properties etc.

- Then if a debtor goes into business rescue, immediately –

- Take advice on how best to enforce/preserve your rights against the surety/ies.

- Secure your position well before you are called on to consider any business rescue plan.

The cost of getting this wrong could be high – the creditor in this case is down R370k.

|

|

The Employment Equity Changes – Do They Apply To You?

|

|

(Note: What follows is of necessity only a brief summary of a few highlighted amendments to a complicated piece of legislation – take advice on your specific circumstances)

All employers and employees need to take account of the recent amendments to the Employment Equity Act.

What parts of the Act apply to you?

-

The “Prohibition of Unfair Discrimination” provisions apply to all employers and employees.

- However the “Affirmative Action” provisions apply only to “designated” employers and to employees from “designated” groups (broadly, SA citizens who are black, female or disabled).

Affirmative Action: Are you a “designated” employer?

The requirements to prepare employment equity plans and to implement specified affirmative action measures will (with a few specific exceptions) only apply to you if you either –

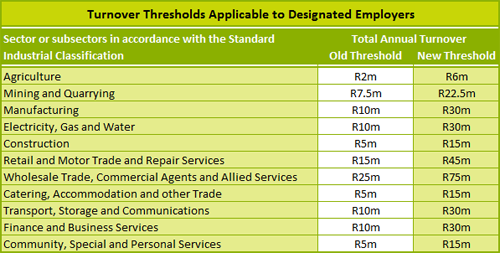

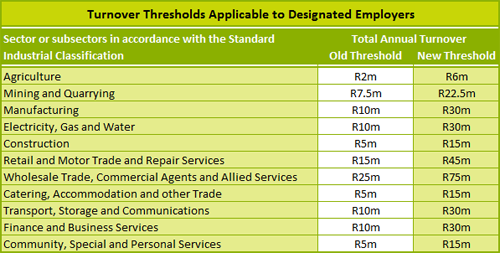

Turnover Thresholds Applicable to Designated Employers

(If the table above does not display correctly, please see the “online version” – link above the compliments slip)

What is “Unfair Discrimination”?

On the other hand, all employers are bound by prohibitions against any form of “unfair discrimination” i.e. discrimination based directly or indirectly on any one of the generally prohibited grounds of “race, gender, sex, pregnancy, marital status, family responsibility, ethnic or social origin, colour, sexual orientation, age, disability, religion, HIV status, conscience, belief, political opinion, culture, language, birth or [this last bit is new] any other arbitrary ground”.

The new rules on equal work, equal pay

An employer is now prohibited from differentiating between employees in regard to “terms and conditions of employment” (which would include remuneration, working conditions etc) in circumstances where –

- The employees (the comparison extends only to employees of the same employer) perform “the same or substantially the same work or work of equal value”, and

- The differentiation is based on any of the generally prohibited grounds listed above.

Beware the increased penalties

Contraventions of the Act carry greatly increased penalties, with first offenders risking a fine of the greater of R1,5m (tripled from the former maximum of R500,000) or 2% of turnover.

|

|

Living Wills: What Are They And Do You Need One?

|

|

“No one can confidently say that he will still be living tomorrow” (Euripides)

We will all die. We have limited control over what will eventually kill us and when, but there is something that we can do now, whilst we are still physically and mentally capable of doing so, to express our wishes as to how we die. Specifically, we can give instructions now as to what medical treatment we want to be given at the end. For many people a nightmare scenario is to be kept artificially alive, quite possibly in pain and distress, long after your medical condition becomes hopeless and long after you have lost the ability to express your wishes for yourself. If you are one of those people, consider executing a Living Will - but do it now, while you still can.

What is a “Living Will”?

A Living Will is your personal “advance health care directive”, executed by you before you lose the ability to do so, in which you tell doctors, hospitals and your loved ones what end-of-life medical treatment you do and do not consent to. For many people it will be an expression of your wish to be allowed to die naturally, with the support of only such medical measures as will relieve your distress and pain without pointlessly prolonging your life. It will speak for you when – and only when - you are no longer capable of doing so yourself.

It will be easier for your family and doctor to make the necessary decisions on your behalf if you have previously run through with them any “What if …..?” scenarios that particularly concern you (or them), and if your wishes in each such scenario are clearly expressed and understood. Most importantly, make sure that everyone knows exactly where your Living Will is – they may need to find it in a hurry.

You also need a “Last Will and Testament”!

Note that a Living Will isn’t a “will” in the normal sense of a “Last Will and Testament” regulating the distribution of assets to your heirs after you die. You certainly do need to execute such a will right now if you don’t already have one, but a “Living Will” is a very different thing. You need both.

Is a Living Will valid?

This isn’t the same as euthanasia or “assisted suicide”, which remain unlawful in South Africa, as well as running foul of many people’s moral/cultural/religious objections. But whereas euthanasia and assisted suicide involve an active intervention to terminate life, a typical Living Will merely expresses your wish that nature be allowed to take its course when the time comes.

Although the enforceability of your Living Will cannot be guaranteed (the legal principles involved are yet to be tested in our courts), at the very least it should make it easier for your loved ones (and the medical professionals charged with caring for you at the end) to take hard decisions if and when they need to be taken.

|

|

Tax Dispute? New Rules, Requirements

|

|

If you are unlucky enough to end up in a dispute with SARS, following the correct procedures – and in particular complying with the required time-frames – is critical. Be aware of new regulations specifying detailed procedures for objections, appeals, ADR (alternative dispute resolution), Tax Court applications etc.

This is a specialised field and the stakes are high - take advice from a registered tax practitioner in any doubt.

|

|

The September Website: Grab A Graduate

|

|

It isn’t easy these days for a new graduate to find suitable employment, particularly with a CV that is devoid of relevant work experience.

Equally, many SMEs would benefit from being able to access the skills, youthful energy and creativity of a new graduate. But they balk at taking on the risk and cost of permanently employing someone unknown and untested.

The win-win answer for both unemployed graduates and SMEs may be a fixed-term internship. See for example the “GAP” Graduate Asset Programme (at www.gogap.co.za) which connects businesses with graduate interns via a free matching portal. The site also provides a wealth of information and resources – for more, download their online pamphlet “Grab a Graduate – Get the intern advantage!” from their Business Tools page at www.gogap.co.za/toolshed/download/111. |

|

Note: Copyright in this publication and its contents vests in DotNews - see copyright notice below.

|

| |

|

|

|

|