|

|

| |

|

March 2023

|

Installing Home Solar – How to Comply with the Regulatory Requirements

|

|

“We have this handy fusion reactor in the sky called the sun; you don’t have to do anything, it just works. It shows up every day” (Elon Musk)

Eskom’s no-end-in-sight loadshedding, rising electricity costs, South Africa’s abundance of sunshine, and the global move to sustainable energy solutions have all contributed to the current boom in home solar photovoltaic (PV) roof installations.

They don’t come cheap, but quite apart from the direct practical and financial benefits of going as much off-grid as possible, you will be boosting your property’s resale value (supposedly by between 4% and 8% depending on the system you install and your current house value). And at least one municipality is already planning to pay you for any excess power you feed back into its grid – expect that to become a growing trend.

Moreover, in addition to the existing tax incentives for businesses installing solar, the Budget Speech has promised both an expansion of the tax incentives and the introduction of a new tax incentive for individuals in the form of a 25% tax rebate (maximum R15,000 per individual) of the cost of “new and unused” solar panels (not inverters or batteries) – available for 1 year only (1 March 2023 to 29 February 2024) “to encourage investment as soon as possible”.

Step 1: How to choose an installer for a safe and legal installation

Before you accept a quote for your solar project (typically some solar panels, an inverter and a battery or two), there are several regulatory requirements to bear in mind, and the best way to ensure that you comply with everything (quite apart from the safety aspect) is to choose an installer with a good track record and the right qualifications. Bear in mind that you will need your installer to issue a valid compliance certificate for the system for several reasons –

- To complete the process of getting the system authorised (see below),

- To add the system to your homeowner’s insurance,

- To ensure that the system’s warranties aren’t voided, and

- To allow you to claim the new tax rebate as above.

Questions to ask a prospective installer: Here’s a list of questions to ask (adapted from the excellent list in “City of Cape Town’s Checklist for safely going solar” on cape{town}etc) –

- What prior experience do you have in solar PV installations?

- What three recent clients of yours can I phone for references?

- Did you design, supply and install the systems, or did you only carry out one or two of these steps?

- Are you an accredited service provider under PV Green Card, SAPVIA or P4 Platform?

- Can you supply proof of electrical Certificates of Compliance and/or professional engineer sign-offs on previous installations?

- Can you prove that your previous installations were correctly authorised by the local authority (or Eskom if direct customers)?

- Do you employ or subcontract qualified staff to design and install systems? (Note: The City of Cape Town suggests you ask for “proof of up-to-date registration (a wireman’s licence and DoLE registration)”).

- Is the inverter you are quoting for on the local authority’s approved inverter list? (Note: Find the City of Cape Town’s list here; if you are told that your local authority has no such list, get written confirmation).

- If you propose a “grid-tied system” (see definition below) do you have available an Engineering Council of South Africa (ECSA) registered professional to sign it off?

- Are the solar PV panels in compliance with SANS/IEC standards? (Note: The City of Cape Town article recommends you get a certificate of compliance for SANS/IEC 61215:2015 / SANS/IEC 61646:2016).

- Are you registered with SAPVIA and the ECB? (Note: Per The City of Cape Town “it’s not compulsory but shows commitment to industry best practice.”)

- What warranties apply to your installation and the components? (Keep proof, with all manuals).

- Is your quote comprehensive and does it include installation of circuit breakers (specialized to the DC current from the panels), obtaining SSEG registration (see below) and a Certificate of Compliance?

Step 2: How to comply with all regulatory requirements

- Next, comply with the SSEG (Small Scale Embedded Generation) process – have your chosen installer do everything on your behalf. You will need to register the system for authorisation with either Eskom or your local municipality (whichever supplies your electricity).

- Note that authorisation is needed whether or not your system will be feeding electricity back into the grid. If your system will connect to the grid (via your distribution board or directly) it will be a “grid-tied” one - either “feed-in” or “non-feed-in” depending on whether or not it will export excess power to the grid. If it’s “non-feed-in” you will need to have “Reverse Power Flow Blocking” installed to prevent any excess electricity feeding back into the grid. If it’s a “feed-in” you have more hoops to jump through as an Electricity Supplier. To complicate matters further, you also get “hybrid” systems which can be either on-grid or off-grid. For more detail read the City of Cape Town article referenced above (“The three types of systems” section).

Incidentally none of this is just bureaucratic red tape – suppliers need to know when it is safe for their technicians to work on the grid, there are issues related to grid management, and there are home safety issues around risk of fires and other hazards.

Check with your supplier (local authority or Eskom) whether you need any authority for a standalone (“off-grid”) system. At date of writing, at least one municipality - City of Cape Town - does require registration “to ensure they are not mistaken for grid-tied systems”.

- The process itself, let alone the terminology and technical requirements (such as wiring diagrams and an engineering sign-off), is complicated. Have your installers do everything for you, and in doubt contact your municipality’s electricity department (or Eskom direct if applicable) for more information.

- Failing to register and obtain written authorisation prior to installation could be an expensive business, with some municipalities threatening to use aerial photos, inspections and billing analysis to locate unauthorised systems, which will then attract penalties, contravention notices, and supply disconnection. Failure to register might even cause your insurers to reject a claim and that could be disastrous - think for example of a system failure causing a house fire.

- If you live in a “community scheme” like a sectional title complex or a homeowner’s association complex, check your Rules and Regulations and get necessary consents upfront.

- Make sure that all aspects of the installation comply with local regulations to reduce the risk of any future insurance claims being rejected for non-compliance. For example, check the technical requirements for roof structures (ensure that they can cope with the weight and wind load of panels), also you may or may not need building plans, plus some municipalities have lists of approved inverter makes and models.

- Talking of which, don’t forget to send the compliance certificate to your insurers with an instruction to add your new system to your homeowner’s policy.

Safety and recourse for poor work

The City of Cape Town checklist referenced above is well worth a full read regardless of where you live – read in particular the sections on safety and “Recourse for poor work”.

A final thought - should you ditch Eskom altogether?

A final thought – you could of course go off-grid entirely. It’s tempting isn’t it to wave Eskom and all its issues a cheerful good-bye, you’ll be avoiding a lot of the paperwork mentioned above, plus you won’t be paying Eskom’s “fixed service connection fees” any longer. But then you really will be on your own, with no connection whatsoever to your municipal or Eskom supply. Think about the effect on your resale value as well as the short-term pros and cons of making that sort of decision!

|

|

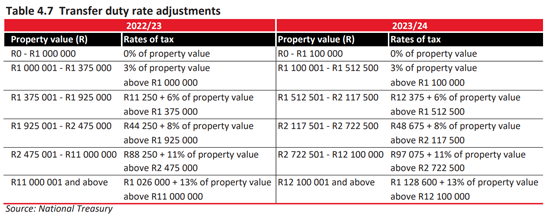

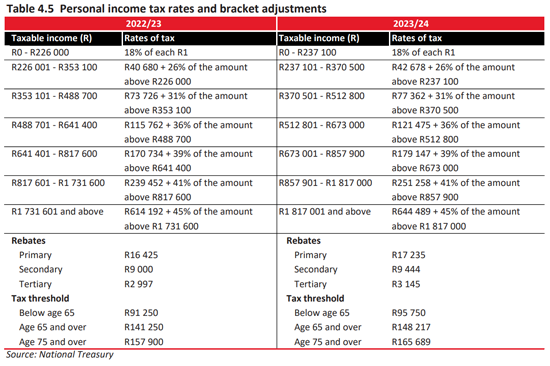

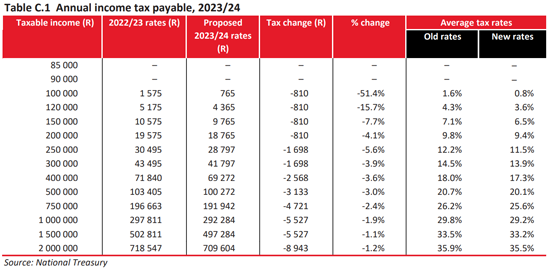

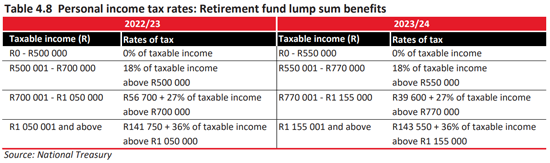

Budget 2023: Your Tax Tables and Tax Calculator

|

|

How much will you be paying in income tax, petrol and sin taxes? Use Fin 24’s four-step Budget Calculator here to find out.

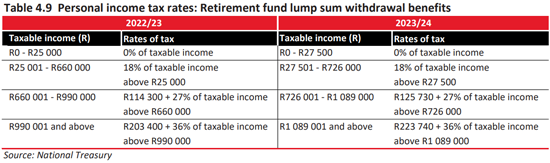

Have a look at the tax tables below for the new tax rates and comparisons with last year’s rates -

View Source Here

|

|

Can You Claim Damages After Hitting a Pothole?

|

|

“The American Automobile Association estimated in the five years prior to 2016 that 16 million drivers in the United States have suffered damage from potholes to their vehicle including tire punctures, bent wheels, and damaged suspensions with a cost of $3 billion a year.” (Wikipedia)

Pothole problems are by no means exclusive to South Africa, but we certainly do seem to have more than our fair share of them.

As a recent High Court decision illustrates, if you suffer any form of loss as a result of a pothole, hold whoever is responsible to account. Sue for your damages!

Injured motorcyclist awarded damages

- Descending a pass on a provincial road with a group of fellow bikers, a motorcyclist leaned into a corner on a sharp bend then hit and went over a pothole. He lost control of the bike which then skidded across the road surface, injuring his shoulder and arm and damaging his clothing and motorbike.

- He was taken by ambulance to hospital, underwent surgery, and although discharged after four days, still two years later is taking painkillers and undergoing physiotherapy for ongoing pain and restricted use of his shoulder and arm.

- An expert confirmed that he had had no opportunity to avoid the pothole and thus the accident. It was also clear that an attempt had been made to repair the pothole.

- He had suffered permanent injuries which “have left him greatly compromised and vulnerable.”

- He sued the Province for damages, and was no doubt pleasantly surprised when the MEC made no effort to defend the action. However, he still had to prove his claim…

Proving negligence, and loss

The Court confirmed that the onus is on a claimant to prove negligence on the part of the local authority, even when, as in this case, the MEC had taken no steps to defend the claim and it was uncontested.

Finding from the uncontradicted evidence of the biker and his expert witnesses that the MEC was solely negligent for the accident in failing to live up to the responsibility “of building, maintaining road infrastructure and putting up road signs cautioning road users of the dangers of potholes”, the Court held him liable for the claimant’s proved damages.

The Court awarded the claimant damages of R850,000 in respect only of those aspects of his claim that he had led evidence to support (future medical treatment and general damages). That figure could increase – although he had failed to produce evidence in support of his further claims (for loss of earnings and damage to property), he can still re-institute action for them.

So, do you have a claim?

You quite possibly do have a claim for any losses you suffer after hitting a pothole. Considering our courts’ attitude to the responsibility of local authorities for road maintenance, proving negligence may not be that hard. Line up also evidence to support all aspects of your claim.

|

|

Effective 1 March 2023: New Earnings Threshold and National Minimum Wage

|

|

Employers and employees need to keep an eye on the annual increases in both the National Minimum Wage and the Earnings Threshold, summarised below for your convenience. Both are effective from 1 March 2023.

The National Minimum Wage increase

The National Minimum Wage (NMW) for each “ordinary hour worked” has been increased by 9.6% from R23-19 to R25-42. Workers who have concluded learnership agreements in terms of the Skills Development Act are entitled to a sliding scale of allowances.

Domestic workers

Domestic workers were brought into line with the NMW in 2022, and assuming a work month of 21 days x 8 hours per day, R25-42 per hour equates to R4,270-56 per month. The Living Wage calculator will help you check whether or not you are actually paying your domestic worker enough to cover a household’s “minimal need” (adjust the “Assumptions” in the calculator to ensure that the figures used are up to date).

The Earnings Threshold Increase

The annual earnings threshold above which employees lose some of the protections of the Basic Conditions of Employment Act has been increased by 7.6% from R224,080-48 p.a. (R18,673-87 p.m.) to R241,110-59 p.a. (R20,092-55 p.m.).

"Earnings" (for this purpose only) means “the regular annual remuneration before deductions, i.e. income tax, pension, medical and similar payments but excluding similar payments (contributions) made by the employer in respect of the employee: Provided that subsistence and transport allowances received, achievement awards and payments for overtime worked shall not be regarded as remuneration”.

Some employees enjoy only limited BCEA protection even if they earn below the threshold - notably any “senior managerial employee" (“an employee who has the authority to hire, discipline and dismiss employees and to represent the employer internally and externally”), any “sales staff who travel to the premises of customers and who regulate their own hours of work” and any “employees who work less than 24 hours a month for an employer”. Take specific advice for details.

The threshold also impacts on some of the protections provided in the Labour Relations Act –

- Employees earning less than the threshold, if contracted to a client for more than three months through a temporary employment service (“labour broker”) are deemed to be employed by the client unless they are actually performing a temporary service.

- Fixed-term employees earning below the threshold are deemed to be employed indefinitely after three months unless the employer has a justifiable reason for fixing the term of the contract.

Turning to the Employment Equity Act, employees earning over the threshold can only refer unfair discrimination disputes (other than disputes based on sexual harassment) to the Commission for Conciliation, Mediation and Arbitration (CCMA) with the consent of all parties. Otherwise, they must go to the Labour Court for arbitration.

|

|

Legal Speak Made Easy

|

|

“Huur gaat voor koop”

Property sellers, buyers and tenants – understand the important legal principle "Huur gaat voor koop". It gives a tenant the right to continue living in a property until the lease agreement ends, even if the property has a new owner. In other words, the property is bought and sold subject to any existing lease, and the buyer steps into the seller’s shoes as landlord. There are other considerations and some exceptions, so legal advice specific to each set of circumstances is essential but the core message remains “Assume the sale is subject to the lease”.

|

|

Note: Copyright in this publication and its contents vests in DotNews - see copyright notice below.

|

| |

|

|

|

|