|

|

| |

|

September 2021

|

Emergency Tax Relief: Is Your Business Eligible and What Should You Consider?

|

|

“SARS will implement these tax relief measures because compliant taxpayers have paid their fair share of tax, making it possible for government to provide such a temporary safety net in a time of extreme difficulty” (SARS)

Battered by national lockdowns of varying intensity since March last year, many businesses have been further affected by weeks of looting and riots in July. These cost 330 South Africans their lives, while our country lost about R50 billion in output, with an estimated 50,000 informal traders and 40,000 businesses affected, placing 150,000 jobs at risk.

For some businesses who had managed to survive in an economy that contracted by 7% last year, it was a final blow. In the economic hubs of Gauteng and KwaZulu-Natal, businesses, shops and warehouses were destroyed or shut down. Virtually all businesses across the country – and in neighbouring countries - were impacted by the resulting food, fuel and medical supply shortages, as well as disruption of supply chains when the ports of Durban and Richards Bay were brought to a standstill and the N3 highway was closed.

In response, on 25 July 2021, President Ramaphosa announced emergency tax measures to assist those affected by the riots and looting.

Three tax relief measures offered

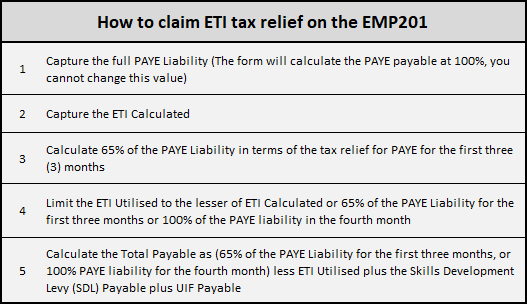

- A tax subsidy of up to R750 per month, for four months, per employee earning below R6,500 - 1 August 2021 to 30 November 2021 - under the current Employment Tax Incentive (ETI) for private sector employers. The first extended ETI can be claimed in your August EMP201 (due 7 September). SARS will pay monthly ETI refunds for the four-month period commencing on 13 September, subject to verification or audit steps required.

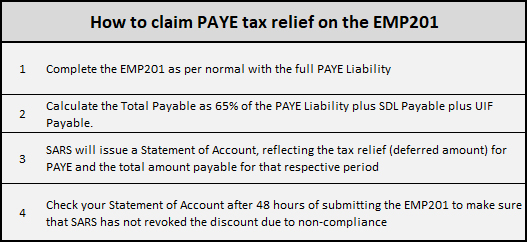

- Deferral of 35% of Pay–As-You-Earn (PAYE) liabilities over the three months - 1 August 2021 to 31 October 2021, without penalties or interest. The first deferment can be claimed on the August 2021 EMP201 return, due 7 September. After 7 November, SARS will determine the four equal payments for the total amount that you have deferred and include it in your monthly Statement of Account. Payments will be made over a four-month period that will commence on 7 December 2021 with the last payment due by 7 March 2022.

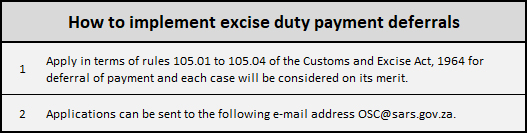

- Deferral of excise duty payments for up to three months for businesses in the alcohol sector.

Note that this deferral is available immediately.

What are the qualifying criteria?

- Only tax compliant companies qualify for the emergency tax measures and that means the business:

- Is registered for all required taxes.

- Has no outstanding returns for any taxes it is registered for.

- Has no outstanding debt for any taxes it is registered for, excluding instalment payment arrangements, compromise of tax debt, and payment of tax suspended pending objection or appeal.

- The employer must be registered with the South African Revenue Service (SARS) as an employer by 25 June 2021.

- The employee tax subsidy applies to tax compliant private sector employers with employees earning below R6,500 per month.

- PAYE deferrals apply to tax compliant businesses with a gross income of up to R100 million, with a limitation that gross income should not include more than 20% of income derived from specific listed sources.

- Excise duty payments deferrals apply to compliant licensees in the alcohol sector that have applied to SARS.

Issues to consider

- You are responsible – The law holds an employer personally liable for an amount of tax withheld and not paid to SARS, or which should have been withheld but was not withheld. The employer could also be held criminally liable for failure to withhold and pay PAYE.

- SARS’s focus on employers – Just weeks ago SARS announced it has teamed up with the NPA (National Prosecuting Authority of South Africa) to deal with tax non-compliance, initially focussing on non-compliant employers. SARS’ Criminal Investigations Division has already handed over 30 non-compliant employers to the NPA in their new joint venture.

- Mistakes are costly - While previously a mistake made by a taxpayer was only a crime when it was done “wilfully and without just cause”, taxpayers can now in certain cases be convicted of an imprisonable criminal offence even if non-compliance was due to negligence or ignorance. If you decide to implement the relief measures, call in professional assistance from your accountant to ensure accuracy and recordkeeping.

- We’ve been warned – Before announcing the details of these emergency tax relief measures, SARS Commissioner Edward Kieswetter made it clear that SARS has the capability to detect and make it costly for those that are non-compliant with their legal obligations and engage in criminal malfeasance. Get a professional opinion to ensure your company qualifies and that the relief is correctly claimed.

- Expect a verification or audit from SARS – ETI refunds will be subject to any verification or audit steps that may be required. Your accountant can assist you in preparing for the likelihood of verifications and audits, and in successfully completing a verification or audit when selected.

- Will you have recovered sufficiently in three months? Three months is a very short time in these unpredictable times. The ability to recover during the grace period is an important consideration: the company’s cash flow will improve initially, but after the three-month deferred payment period, an even higher PAYE liability is due – over the year-end and into the next financial year. Your accountant can help you to carefully project your financial position over the coming months to enable an informed decision.

- Can you afford the deferred tax repayments? While the lower PAYE payments for the three months of August, September and October will provide short-term cashflow relief, one quarter of the total deferred amount must be paid – on top of the company’s normal PAYE obligation for each month between November (due 7 December 2021) and February (due 7 March 2022). If your payment is made late, you will forfeit the benefit of the tax relief for PAYE and SARS will impose penalties and interest on the calculated total payable. It will also create other challenges, such as not being able to obtain a tax clearance certificate required for loan applications and tenders.

While these tax measures introduced for employers may be a lifeline for some companies to survive, all businesses are well advised to call on the advice and assistance of their accountant, both when carefully considering the decision to take up this tax relief and in claiming the tax relief.

|

|

Business Combinations: A Path to Exponential Growth and Profitability?

|

|

"If everyone is moving forward together, then success takes care of itself" (Henry Ford)

Initiating, setting up and launching a new, typically, small business is a challenge and can be a lonely journey to growth and, hopefully, success.

Could developing a partnership or co-operative with like businesses be a pathway to growth and profitability?

How do you describe your business?

Truly understanding how to properly describe what your business is can make the difference between success and failure. This is an important consideration for both the entrepreneur and potential customers. Is a company that uses a truck(s)/bakkie(s) to move goods around simply a moving company or is it in reality a logistics organisation offering a range of transporting options? A proper description can put what the organisation really is in proper perspective for those who are looking for a supplier of goods or services.

Next, ask yourself “Are there other products or services that relate to what my business does and should we pool our resources?”

The story of a plumber and how he grew his business

Consider, for example, the construction industry. Not the big guys but those who supply into that industry. Tradesmen such as plumbers, carpenters, electricians, painters, plasterers and so on.

Some years ago a plumber who had a good reputation (an essential element) for both the quality and timing of his work wanted to grow and develop the operation. He had a team working with him but found it difficult to scale up the business.

Because of his standing (reputation) in both the residential and commercial construction industry, he had been asked, from time to time, to recommend other tradesmen of similar quality. He turned those requests into a growth business. He approached the artisans he had worked with who had proved to be reliable and for whom he had a good regard and suggested they join his business. He explained how it would work.

He would find the work for them and refer them to the client. This was in respect of all the trades servicing and supplying the industry. He took a small percentage of the fee/charge for the following benefits he offered these tradesmen:

- Work sourcing,

- Administration for them (and their teams if they were more than ‘one-man bands’),

- Handling all the finances, banking, submission of regulatory returns,

- Sourcing of supplies for them where necessary,

- Managing their payrolls and attendant administration,

- Other issues.

Of course, there was a simple written agreement between his little company and those who contracted with his business.

The consequences of this “pooling” of talents and services

- His business grew in influence, reach and demand as its reputation grew,

- There was a growing demand from tradesmen to join his operation, and he was able to be selective in deciding with whom he would develop relationships,

- Because of the aggregation of supplies he sourced he was able to obtain quantity discounts. He retained part of these savings which went to meet the costs of his business with the balance being passed on to the tradesmen contracted to his operation,

- The individuals who contracted with his business were able to scale up their operations as they were introduced to suitable lucrative and reliable contacts who paid their bills on time and in full,

- Eventually, some decided to go on their own. This was always his expectation, that once they were on a sound footing they would develop their own operations further,

- He was able to turn his full attention to growing the broader operations even though he kept his hand in his original plumbing operations,

- Finally, he was never greedy and kept his focus on growing both his and his cooperative partners’ businesses.

His operation grew exponentially and after many years he retired a well-off man who had the satisfaction of having contributed to the well-being and success of others in a tough industry.

What do you need to consider?

Once you have determined exactly what your business really can be described as, consider whether there are any other businesses that relate more or less naturally to your operations.

Is there an opportunity for you to ramp up your operations to offer relevant services to these businesses to grow both their and your operations and provide your business with additional income streams?

The construction industry example used here is but one where collaboration could lead to growth and improved performance and income generation.

|

|

The Top 5 Leadership Skills Every Entrepreneur Needs

|

|

"The pessimist complains about the wind. The optimist expects it to change. The leader adjusts the sails.” (John Maxwell)

To be a good leader in the small business environment a person needs to possess a variety of skills, understand themselves and recognise areas where there is room for improvement. The leader’s abilities will be the main driver for growing the business. An effective leader is required to not only guide a company from a financial perspective, but also to build a team that is accountable and designed to get results. On the surface this sounds like a simple statement, but here are the five main skills that it takes to develop that end goal.

- Motivation

Leadership is not just about charting the right business course. At the end of the day, profit and loss will be determined by the strength of the team working in the company and by how motivated they are to do their very best.

A recent study conducted by Dr Kou Murayama at the University of Reading found that when people are motivated, they learn better and remember more of what they have learned.

Great business leaders are capable of establishing a positive culture in their organisation, and to do that they need to lead from the front. A true leader needs to exemplify the values they want to instil in their employees and motivates their team through their passion and accountability. That said, a leader cannot believe that they alone will be able to inspire their employees to greatness and they should not diminish the value of rewards in motivation. Simply adequately rewarding your team with good salaries and other non-monetary bonuses and offers can inspire them to do better work.

According to recent findings in a cognitive neuroscientific study by Adcock, Thangavel, Whitfield-Gabrielli, Knutson & Gabrieli, rewards enhance learning, focus and enthusiasm due to the modulation of hippocampal function by the reward network in the brain.

Motivation then is a blend of the character of the leader, the culture within the company and the rewards being offered in return for effective and productive employees. A good leader needs to take all that into account to get the most from their team.

According to Kara Kelly, Executive Director of CompleteContents.com, “Leadership is not about who is in charge. It's about making sure your team stays focused on the goals, keeping them motivated and helping them be the best they can be to achieve those goals. This is especially true when the risks are high and the consequences matter."

- Communication

Good, honest communication with both employees and clients is one of the key pillars to small business success. The leader is the one primarily responsible for developing a good communication system and culture within the organisation and for ensuring employees are able to effectively communicate the necessary information, opportunities and problems they perceive to the right people, quickly and easily. Forbes reports that one of the simplest ways new businesses collapse is through either a lack of communication or through too high a complexity level of communication.

Employees should feel empowered to communicate directly with those in charge if they perceive problems or notice opportunities and should be rewarded for doing so, and feedback to both employees and clients should be frequent and simple.

A bad communication system is one that generates numerous, complex reports that have to travel through a chain of command before it reaches the right person. Leaders should focus on being accessible, communicating more simply and more often to ensure all parties are fully aware of what needs to happen, and the details associated with it. Your lowest level employees and clients don't need 60 page reports filled with complex graphs and algorithms explaining what you are going to do– a quick message to outline targets and how they will be achieved, by which deadline is far more effective.

- Passion

The best leaders are absolutely passionate about what they do and their company as it's impossible to become successful at something that one does not care about. Before starting an endeavour a business leader needs to seriously ask themselves if what they are doing is something they are passionate about. The early years of a business are filled with grind, difficulty and setbacks and tackling all this without passion for what you are doing is close to impossible.

Passion for a business also has numerous other positive side effects for it such as drawing the right consumers, building networks with similarly minded individuals, and creating authenticity that your audience (suppliers, customers and employees) will identify with.

But obviously not all businesses are born out of passion for the product. Not many plumbers for example will say that the one thing they always wanted to do when they left school was work with pipes and bathroom fittings! These leaders find their passion in other places and inspire themselves by perhaps knowing that they are providing necessary and helpful services to people in need, that they are doing good, providing for their families or giving themselves, and their employees, the kind of lifestyles they all really want. Finding genuine passion for your business, from whichever source, will ultimately be one of the biggest factors in also discovering success.

- Interview Skills

In the early days of a business being able to find and recruit true talent can make or break a company. An entrepreneur needs to be their own Human Resources department and discovering and nurturing true talent is therefore absolutely essential. Finding the right candidates begins when determining what kind of candidate is truly needed in the company. All too many job adverts claim to want someone who is a “copywriter, graphic designer and SEO specialist, who dabbles in social media and has three years agency marketing experience”. These adverts show a clear lack of leadership in the company, because unicorns with that kind of diverse experience are extremely rare, and clearly the roles the company really needs filled have not been considered carefully enough.

Defining exactly what it is a company needs will allow the entrepreneur to advertise the position effectively, remunerate fairly and therefore attract the right kind of person into the role.

After attracting the right candidates to an interview, the intelligent small business employer will then focus on a few key things at the interview stage. Interviews should focus on “behaviour based interviewing” or interviews that focus on examples of past behaviour and achievements. What the interviewer is looking for is someone who can effectively work and deliver unsupervised as they won’t have the capacity to watch over that employee 24/7. A good trick is to send in someone you trust to have a casual chat with the employee while they are waiting for their interview, or when you need to “step out” for a few minutes. This employee will be more likely to get a sense for how the person really is and determine if there is good chemistry.

Understanding a potential hire's motivations for taking a job is also critical. You need to know this person is as passionate as you are about making your company work and isn't just in it for the money or, looking to fill a short-term role. In the end, you want to ensure whoever you hire will be there a few years to limit the necessary training and wasted time and expense employee churn can create.

- Education and personal development

People who choose to go into business for themselves usually do so for a number of reasons that range from years spent in an industry, to having a good idea, or simply wanting to try something new. Whatever the reasons it’s safe to say that the skills they have at the start of the business are usually not the ones they are going to need in the future as the company grows and expands. A crucial aspect of building a successful business is in the entrepreneur making sure that they are as qualified as possible to meet the upcoming challenges of the company and planning ahead so they aren't caught off guard.

It is therefore essential that any business leader, but particularly those in start-ups, continue to educate themselves on their industry and in business. The more skills a leader has, and the more they understand their company, legislation affecting their industry, new developments and the competition, the more chance they have of making it to the end game. The answer is simple, never stop learning, and encourage a culture in which this is true of each employee in your business.

As John F. Kennedy said, "Leadership and learning are indispensable to each other."

|

|

SMEs and Microinsurance: Benefits and Risks

|

|

“Do you know the difference between education and experience? Education is when you read the fine print; experience is what you get when you don't” (American singer and social activist, Pete Seeger)

Microinsurance refers to an area of cover made accessible to low-income individuals and businesses at relatively low cost. Within the South African context, they originally dealt heavily with funeral insurance. Since 1 July 2018, in terms of the Insurance Act of 2017, microinsurers were allowed to offer additional product offerings.

The Insurance Act introduced a new microinsurance license category. Now microinsurers may be profit-making, not-for-profit or co-operatives. This has brought stability to the sector and even opened up the market, and extended the list of options.

Legislation included a time cap on contract terms of 12 months for life insurance and a “No Waiting Periods” law for policies covering accidental death or disability, as well as credit risk policies.

The importance of the microinsurance sector for local SMEs

A South African Microinsurance Case-Study, which was conducted by the University of the Western Cape (UWC) for the International Labour Organisation, surveyed SME operators to assess the risks that they face and then explored the possibility of insuring those risks.

It concluded that “there is an important, albeit limited, role for microinsurance (especially life insurance)” among SMEs. The case study assessed the risks SMEs face in totality, from operational to employee benefits.

The avoidable financial risks negligent SMEs face

Given the many companies advertising funeral cover, employees of SMEs should first find out if such cover is offered as an employee benefit to avoid making unnecessary contributions to their own policies given the payout caps in the event of a claim.

Accordingly, SMEs which contribute to their employees’ life insurance and/or funeral policies as benefits, run the risk of wasting money should they not fully understand the regulations relating to these policies. This should be fully discussed with employees as the impact of the R100 000 cap on life and/or funeral cover affects SMEs which offer these employee benefits directly to staff. For example, if an employee is covered by multiple funeral policies and a claim is filed, the insurers will scrimmage and divide the R100 000 cap liability among themselves. Regardless of the policies’ individual values, not a single rand will be paid beyond that amount.

These are usually taken out as group covers. Communicating with employees is vital as there is no need for multiple funeral policies if the R100 000 aggregate sum is reached.

Advantages of using microinsurance over traditional insurance

- They provide cover at lower premiums.

- No exclusion is allowed due to pre-existing health conditions for funeral and credit life insurance policies.

- Excesses only concern the non-life insurance policies.

- Authorisation and payment of claims are not allowed to take more than two business days.

- SMEs that have microinsurance cover for employees have them as group schemes with less admin and red tape as compared to traditional insurance.

Disadvantages of using microinsurance

- Many microinsurance schemes are said to have relatively poor viability and sustainability, so products require more scrutiny in order to be considered safe.

- SMEs need to be aware of the cap of R100 000 maximum payout in the life and funeral insurance category and the R300 000 cap in the non-life category.

- Products are usually not comprehensive in the non-life category.

Seek professional assistance to find the best microinsurance options available in order to avoid being trapped by the fine print.

|

|

Your Tax Deadlines for September 2021

|

- 07 September – Monthly Pay-As-You-Earn (PAYE) submissions and payments

- 23 September - Value-Added Tax (VAT) manual submissions and payments

- 29 September - Excise Duty payments

- 30 September - Corporate Income Tax (CIT) Provisional Tax payments where applicable

- 30 September - End of the 2nd Financial Quarter

- 30 September - Personal Income Tax (PIT) top-up Provisional Tax payments.

|

|

Note: Copyright in this publication and its contents vests in DotNews - see copyright notice below.

|

| |

|

|

|

|