|

|

| |

|

September 2023

|

Using a “Risk Matrix” to Risk-Proof Your Business

|

|

“Don’t be fearful of risks. Understand them, and manage and minimize them to an acceptable level.” (Naved Abdali, Financial journalist and author)

Managing risk in your business is absolutely critical for developing it to success. Knowing exactly which threats are really relevant and which will help any leader to develop strategy and prepare for the worst eventualities. One of the simplest and most useful ways of determining the greatest risks to a business is through developing a “risk matrix”, otherwise known as a “risk assessment matrix”. Risk matrices give leaders a visual way of understanding the risks in their business by plotting these risks on a grid.

An example to illustrate…

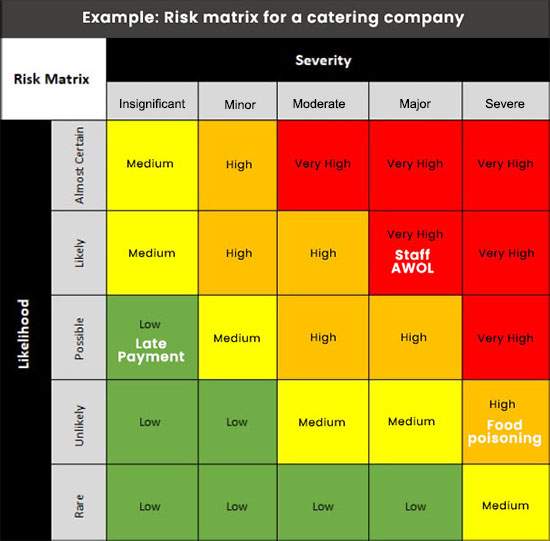

Let’s illustrate the concept with the help of an example. A catering company has identified three risks to its business and has plotted them on a typical matrix which looks like this –

Source: Adapted from a template available for free download from ProjectManager.com

As you can see –

- The caterer has decided that a food poisoning event is deemed to be unlikely but with severe consequences. This puts it in the orange “High” category.

- Staff not arriving for shift is deemed likely with major consequences. This puts it in the red “Very High” category.

- Catering customer paying a month late is deemed possible with insignificant consequences. This puts it in the green “Low” category.

This allows the caterer to visually compare the identified risks with one another at a glance, and to prioritise addressing them.

Create your risk matrix in the context of your own business

Any risk that is high on the likelihood scale and high on the consequence scale needs to be paid attention to immediately, while conversely those that are low on both axes can be attended to last.

Leaders would determine where each individual risk falls on the matrix dependent on the context for their own business. For example, while a food poisoning risk may be a very low risk and unlikely event at a mining company, it is more likely for, and could mean bankruptcy for, a catering company.

This simple outline may differ depending on the organisation or leader using it. Often, they appear colour coded with severe risks marked in red and less severe ones in blue or green. The effect of the matrix, however, remains the same, so choose whichever format works for you.

How to build your risk matrix

There are essentially four steps to creating a risk matrix, each of which will be influenced by your knowledge of your business and its particular details.

- Identify risks

The first step is to identify all the likely risks to your business. You cannot plan for things that you don’t know about and haven’t imagined. At this stage every avenue should be covered, and each eventuality considered. The catering company cannot prepare for a mass food poisoning if they have never even considered it enough to put it on their risk matrix. Risks are not just direct dire threats, however, and include anything that could prevent your company achieving its goals or bring harm to its staff or customers or investors.

- Evaluate them

This is the critical stage that makes the risk matrix work. Looking at the list of risks, you must determine which of those could cause a critical failure to your business and which are merely small annoyances. You should also determine which of these risks are likely to happen and which are more fanciful and unlikely. This is a subjective decision you will make dependent on the unique circumstances of your own company.

In the catering company example above, we have mentioned how a client paying late may be of insignificant consequence. Perhaps this is an established company, with good cash reserves? A newer company, that is not in as strong a position may deem the risk level of a late payment to be closer to severe making it a “Very High” threat to the existence of the business.

- Enter them into the matrix and prioritise them

Now that the threat levels have been determined, these values can be entered into the matrix and the danger of the various threats can be measured against one another.

Low risks, or those that would fall within a green area, can generally simply be accepted and no risk-mitigation actions need to be taken.

Moderate risks, or those that would fall within the yellow area, will likely need risk-mitigation strategies to reduce their likelihood or improve circumstances should they occur.

High risks, or those that fall within the red area, need to be urgently attended to. Processes need to be put in place to eliminate these risks or greatly reduce their likelihood of occurrence. This may involve staff training, or changes to entire systems of logistics and ordering.

Continued analysis

Risk management is not something that is set in stone. Risks may move within the matrix over time dependent on internal and external factors. Increasing interest rates, for instance, may move cash flow problems higher up on the matrix, while the discovery of new mineral deposits may make the threat of raw material shortages lower. Leaders should be prepared to update their matrices in-line with these new events.

Weaknesses

While risk matrices are extremely useful in decision making, problem solving and communication of challenges, they are not without their weaknesses. Good leaders should be cognisant that due to the matrix’s reliance on context and the leader’s own subjectivity, errors can creep in due to over- and under-estimation of threats. A risk matrix is therefore something that should be shared with the team, and other interested parties such as investors, and partners, and feedback should be sought to lower the risk of this happening.

The bottom line

In the end, risk matrices are a powerful tool to help you manage your company’s risk. In the hands of knowledgeable and experienced leadership they have helped numerous companies to thrive or to avoid harm when the risks eventually become realities.

Ask your accountant to help you identify and address those risks that are particularly relevant to your business!

|

|

Common Tax-Related Criminal Offences, and How to Avoid Them…

|

|

“The difference between tax avoidance and tax evasion is the thickness of a prison wall.” (Denis Healey, former British prime minister)

Section 234 in Chapter 17 of the Tax Administration Act (TAA) sets out a list of criminal tax offences. If prosecuted and convicted of a tax criminal offence, taxpayers will - at the least - be subjected to a substantial fine and may even face the maximum penalty of imprisonment for up to two years. There are also other harsh consequences of a criminal conviction under section 234, such as a negative impact on the eligibility of individuals to hold certain positions and to emigrate from South Africa, as well as reputational damage and a loss of both shareholder value and stakeholder trust for corporate taxpayers.

These tax criminal offences range from serious offences, such as intentional tax evasion and frustrating SARS in carrying out its duties, to relatively minor breaches, such as failing to notify SARS of a change in registered particulars.

Common tax criminal offences

- Not registering for tax purposes to evade paying taxes due.

- Not submitting returns to SARS as and when required to evade paying taxes.

- Not truthfully responding to SARS’ questions.

- Not declaring income to evade paying tax on that income.

- Lying about expenses, like business mileage or medical contributions, to reduce tax payable or obtain an undue refund.

- Submitting fraudulent invoices to reduce Income Tax and VAT payable or obtain fraudulent refunds.

- Employers deducting tax from employees (PAYE) and never paying it over to SARS.

- Vendors, whether registered for VAT or not, charging VAT and never paying it over to SARS.

- Not notifying SARS of a change in registered particulars.

- Not retaining records as required under the TAA.

- Issuing an erroneous, incomplete or false document required to be issued under a tax Act.

- Neglecting to disclose to SARS any material facts which should have been disclosed.

- Obstructing SARS officials in doing their duties.

How SARS views taxpayer behaviour

While taxpayers were previously merely penalised for human errors and simple mistakes - which are common given the complex tax processes and strict deadlines - a taxpayer can now be found guilty of an offence without SARS having to show that the taxpayer wilfully, deliberately and knowingly committed the offence.

This means even inadvertent or administrative errors can be penalised with a maximum penalty and that a substantially expanded range of taxpayer behaviours - and a greater number of taxpayers - are now open to criminal sanctions.

How to avoid committing tax criminal offences

SARS notes that among the steps that a reasonable person may take to avoid committing tax criminal offences is “employing an accountant, tax practitioner, or other tax professional to complete returns, or from whom to obtain advice before completing a return with entries that are not understood or adopting a position with tax implications.”

Be sure to choose a specialist who is appropriately qualified and experienced, as well as a member of a professional controlling body that enforces strict standards, such as SAICA (South African Institute of Chartered Accountants).

Advice from a professional can ensure that an appropriate tax strategy is formulated to proactively manage tax risk in the long term, which will save time and money and avoid expensive tax mistakes while keeping in line with the ever-changing tax obligations.

|

|

Corporate Taxpayers: Hello Tougher SARS Verifications

|

|

"Any taxpayer can be selected by SARS for verification for the purpose of proper administration of tax, including on a risk basis." (SARS)

Companies must, within 12 months of their financial year-end, submit to SARS an Income Tax Return for Companies (ITR14), as well as supporting documents, declaring their full income tax responsibility to SARS. This declaration, return and supporting documents may be selected for verification by SARS.

A verification involves the comparison of the information declared on the return to the taxpayer’s financial and accounting records and other supporting documents. The purpose of a verification is to ensure that a declaration or return represents a taxpayer’s tax position fairly and accurately.

Previously, when companies were identified for a verification, SARS required them to submit the Supplementary Declaration for Companies or Close Corporations or IT14SD form. This is no longer required by SARS, but it will increase the scrutiny companies face when selected for verification.

What has changed?

The requirement to submit an IT14SD in a verification case is replaced by a letter requesting specific relevant documents based on the reason for verification.

SARS also says that as of September last year, companies are no longer required to submit any outstanding IT14SDs and that should taxpayers receive any further notification or final demand letter to submit an IT14SD, such request should be ignored. However, taxpayers should always check with their accountant before disregarding correspondence of any kind from SARS.

What’s still the same?

- The requirement to submit relevant documents upon submission of the ITR14.

- All correspondence will still be issued as before.

- The process of dealing with the verification case will remain the same.

- The submission of specific relevant documents will be required during the verification process.

- The verification of a company always requires the submission of a signed set of Annual Financial Statements (AFS), as well as a detailed Tax Computation and the underlying supporting documentation/schedules (e.g. Tax pack).

- When requested to submit specific relevant documents based on the reason for the verification, companies are still required to submit the documents within 21 working days.

How does this affect your company?

When a company is now identified for verification, it will be notified of the verification, as is the current practice and will be requested to:

- Submit specific relevant documents based on the reason for the verification, or

- Submit a revised Corporate Income Tax ITR14 return.

To comply with a request to submit specific relevant documents, the requested documents must be uploaded using eFiling, or any other submission channel, including SARS Online Query system (SOQS).

Once the relevant documents are uploaded, a SARS verifier will be able to action the case. If the relevant documents are deemed insufficient, or additional documents are required, this will be requested. The relevant documents must still be provided within 21 working days. If a company does not comply with the request for relevant documents, SARS will raise a revised assessment to resolve the verification case, and will add back the related expenses, dependent on the specific relevant documents requested.

Companies can comply with a request to submit a revised Corporate Income Tax ITR14 return through a request for correction (RFC). Companies have the option of submitting one correction, which may or may not resolve the verification. However, the revised ITR14 will also be subjected to a risk evaluation.

Seek professional assistance

Being selected for a verification entails significant risk to any business. In addition to the time, cost and effort to collate the information, documents and clarifications required, the taxpayer could still be referred for audit as part of the SARS compliance process, even if the verification process has been completed.

Whether submitting a Corporate Income Tax ITR14 return or facing a SARS verification with a request to submit documents or to file a correction, you would be well-advised to rely on the expertise of your accountant to ensure compliance.

|

|

Quiet Quitting and How to Prevent It

|

|

“Quiet quitting” isn’t laziness...When they don’t feel cared about, people eventually stop caring. If you want them to go the extra mile, start with meaningful work, respect, and fair pay.” – (Adam Grant, organizational psychologist and speaker)

The idea of the recently acknowledged trend of quiet quitting is not really new at all. Some people have been coming to work and doing the bare minimum since work has existed. It has, however, become a lot more noticeable and, more important, socially acceptable since the pandemic. It’s therefore unsurprising that a 2023 Gallup report states that as few as 32% of employees now class themselves as engaged at work.

As any business leader knows, workers who are only barely fulfilling the terms of their contracts in the least productive ways can be detrimental to corporate culture and bottom line, and “quiet quitting” therefore does need to be addressed.

Causes

The time spent at home with families during the pandemic has awakened many employees to what work/life balance could be like with a little more life and a little less work. Rather than being the habit it had been before the pandemic, the return to work and the daily commute now seemed unnecessary and expensive. In instances where employees were forced to return to the office, resentment built and, without meaningful communication and explanation from management, began to fester.

At its core, therefore, quiet quitting is not laziness. It’s a direct response to a perception that employees are being used and that management does not really care about their needs, desires or hopes. If they don’t care about me, why should I care about my job?

What can be done?

- Reward employees adequately

The first step toward making an employee feel valued is to actually value them. Resources on the internet make it extremely easy for employees to see what other companies are paying for similar roles and if they aren’t earning the same, they will feel undervalued. Paying a good salary also leads to better employee retention, which lowers your recruitment and training costs and in businesses with small skill pools can ensure you stay ahead of the game. Your accountant will be able to assist you to determine just what you can afford to pay for each role, and how best to structure benefits to get the most from taxes.

- Take care of employee mental health

Those who engage in quiet quitting often state that their mental health was a critical reason why they did so. Proactively addressing your employees’ mental health needs is therefore a priority if you want them to be engaged at work.

It is essential that you make sure work/life boundaries are a built-in aspect of any job. Simple rules like preventing employees from calling each other after hours, or keeping lunch hours free for lunch, will go a long way toward ensuring your employees don’t have to draw those lines themselves.

Other ideas include matching overtime with additional time off or giving employees their child’s birthday as paid leave. Your accountant will be able to help you find funds to develop a wellness program that could include reduced gym fees or tickets to theatre, concerts or sports events.

- Recognise hard work

Feeling underappreciated is a large part of why people quiet quit. Working hard and having no one notice leads to people feeling unrecognised and unimportant. Make sure you acknowledge and visibly reward those employees who do work hard. With the right motivation it could even encourage others to step up as well.

- Listen to your employees

The ultimate reason for quiet quitting is the disconnect between management and staff. It is essential for team leaders to get to know their staff as human beings, to genuinely engage and listen and understand the challenges in their lives. People who view their bosses as caring human beings rather than faceless authority figures are much more likely to work harder to avoid disappointing their team. If they are then also adequately rewarded for doing so, this can lead to a strong positive spiral of effort.

|

|

Your Tax Deadlines for September 2023

|

- 7 September - Monthly Pay-As-You-Earn (PAYE) submissions and payments

- 28 September - Excise Duty payments

- 29 September – End of the 2nd Financial Quarter, Value-Added Tax (VAT) electronic submissions and payments, CIT Provisional payments where applicable.

|

|

Note: Copyright in this publication and its contents vests in DotNews - see copyright notice below.

|

| |

|

|

|

|