|

|

| |

|

March 2023

|

Budget 2023: How It Affects You and Your Business

|

|

“This is not an austerity budget. It is a budget that makes tough trade-offs in the interests of the country’s short and long term prosperity.” (Finance Minister Enoch Godongwana – Budget 2023)

Finance Minister Enoch Godongwana’s second Budget contained no major tax proposals, thanks to an improvement in revenue from higher collection in corporate and personal income taxes, and in customs duties.

Instead, the focus of Budget 2023 was firmly on the current energy crisis, which has resulted in a State of Disaster being declared. It announced that government will take over R254 billion of Eskom’s debt over the next two years, subject to stringent conditions.

Of the tax relief amounting to R13 billion to be provided to taxpayers in 2023/24 announced in the Budget, R9 billion is earmarked to encourage households and businesses to invest in renewable energy. More specifically, R4 billion in relief is provided for households that install solar panels and R5 billion to companies through the expansion of the existing renewable energy incentive.

These incentives are briefly detailed below, along with some of the other announcements that will impact individuals and businesses.

Budget announcements that will impact you personally

- A new tax incentive to install rooftop solar panels: For one year from 1 March 2023, individuals will be able to claim a rebate of 25% of the cost of installing rooftop solar panels, up to a maximum of R15,000, to reduce their tax liability in the 2023/24 tax year.

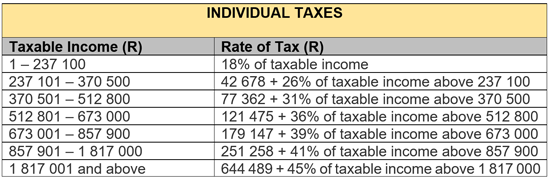

- The personal income tax brackets will be fully adjusted for inflation, increasing the tax-free threshold from R91,250 to R95,750.

- Medical tax credits per month will be increased by inflation to R364 for the first two members, and to R246 for additional members.

- The retirement tax tables for lump sums withdrawn before retirement and at retirement, will be adjusted upwards by 10%, increasing the tax-free amount at retirement to R550,000.

- Revised draft legislation on the ‘two-pot’ retirement system will be published, including the amount immediately available at implementation from 1 March 2024. Withdrawals from the accessible “savings pot” would be taxed as income in the year of withdrawal.

- Social grants will increase in line with CPI inflation. The R350 grant will continue until 31 March 2024.

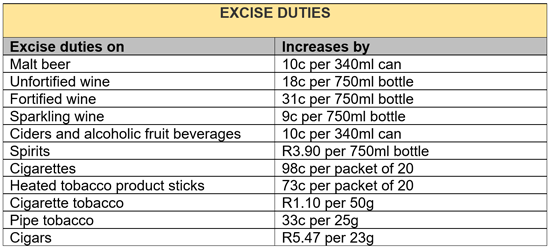

- Increases in the excise duties on alcohol and tobacco of 4.9%, in line with expected inflation. This means that the duty on:

- a 340ml can of beer increases by 10c,

- a 750ml bottle of wine goes up by 18c,

- a 750ml bottle of spirits will increase by R3.90,

- a 23g cigar goes up by R5.47,

- a pack of 20 cigarettes, rises by 98c.

Budget announcements that will impact your business

- Expanding the existing section 12B tax allowance for renewable energy, businesses will now be allowed to reduce their taxable income by 125% of the cost of an investment in renewables for two years from 1 March 2023. There will be no thresholds on the size of the projects that qualify. According to National Treasury, where a renewable energy investment of R1 million is made by a business, that business will qualify for a deduction of R1,25 million, which could reduce the corporate income tax liability of a company by R337,500 in the first year of operation.

- The existing Bounce Back Loan Guarantee Scheme will be updated to become the Energy Bounce Back Scheme, to be launched in April 2023. Government will guarantee solar-related loans for small and medium enterprises on a 20% first-loss basis.

- The research and development tax incentive will be extended for 10 years and will be refined to make it simpler and more effective.

- The urban development zone tax incentive will also be extended, by two years.

- Manufacturers of foodstuffs will for two years (from 1 April 2023) also qualify for the refund on the Road Accident Fund levy for diesel used in the manufacturing process, such as for generators, to ease the impact of the electricity crisis on food prices.

Budget announcements that will impact all

- Providing tax relief of R4 billion, the general fuel levy and the Road Accident Fund levy will not be increased this year. However, the carbon fuel levy will increase by 1c to 10c/l for petrol and 11c/l for diesel from 5 April 2023.

- The health promotion (sugar) levy will remain unchanged for the following two fiscal years.

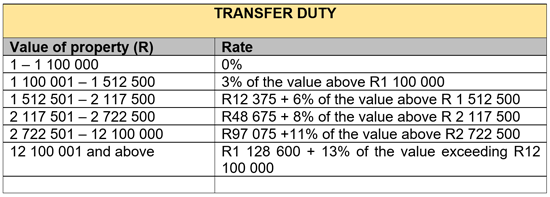

- The brackets of the transfer duty table will also be increased by 10%, allowing properties below R1.1 million to avoid any transfer duty payments.

How best to manage these changes and their impact?

In addition to the announcements detailed above, there were other technical amendments proposed in the Budget review that will require professional advice.

As tax collection remains government’s main source of income, you and your business would do well to rely on the expertise and advice of tax professionals as you determine the impact of the Budget 2023 announcements on your tax affairs.

|

|

Budget 2023: Your Tax Tables and Tax Calculator

|

|

The big Budget Speech 2023 tax news was the introduction of tax incentives for investing in rooftop solar and renewable energy. The Budget also detailed tax relief in the form of adjusted tables for tax and rebates for individual taxpayers, adjusted tables for retirement tax and transfer duty, and the expected increases in ‘sin’ taxes. How will these changes affect you directly?

To better understand the impact of the Budget on you and your business, here is a selection of official SARS Tax Tables, then follow the link to Fin 24’s Budget Calculator to do your own calculation.

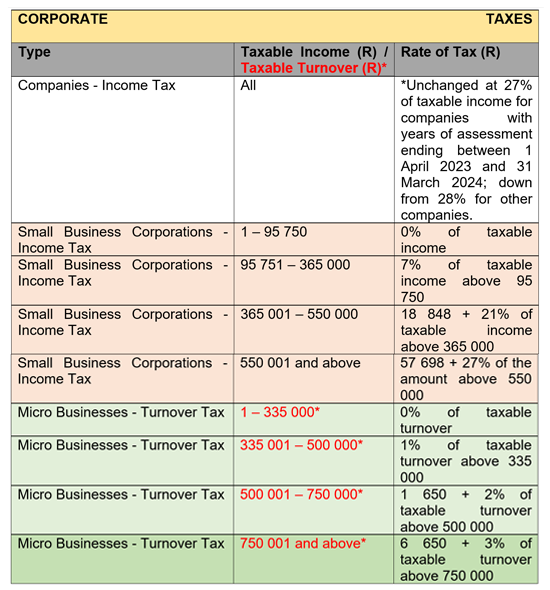

Businesses – corporate tax rates unchanged*

Source: SARS’ Budget Tax Guide 2023

Individual taxpayers – tax tables adjusted

Source: SARS

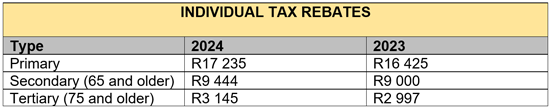

Source: SARS

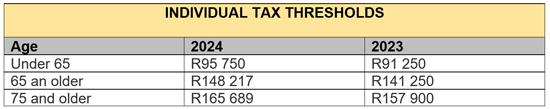

Source: SARS

Transfer duty table - adjusted

Source: Budget 2023 People’s Guide

Sin taxes raised

Source: Budget 2023 People’s Guide

How much will you be paying in income, petrol and sin taxes?

Use Fin 24’s four-step Budget Calculator here to find out the monthly and annual impact on your income tax, as well as what you will pay in future in terms of fuel and sin taxes, bearing in mind that the best way to fully understand the impact of the announcements in Budget 2023 on your own and your business affairs is to reach out for professional advice from your accountant.

|

|

How To Prepare a Reliable Disaster Recovery Plan

|

|

“The time to prepare for disasters is before they happen” (Stephen Matheson, Vice President of Product at BridgeHead)

Given how reliant we all are on our IT infrastructure, it will come as no surprise to learn that one of the worst things that can happen to a business is for a failure to occur in that department. Whether it’s fire, floods, or hacking, being taken offline can spell a serious period of trouble for most organisations. In the time it takes to get back up and operational projects can be delayed, the quality of work can suffer, or worst of all, everything is put on hold for months while data is recreated. All of this can lead to strained relationships with both customers and suppliers and potentially the end of the business.

A Disaster Recovery Plan is the pre-planned process a company will turn to when disaster strikes to ensure that a short-term problem does not become a permanent one.

Here are five simple tips for what you need to consider when drawing one up.

- Have a response checklist

The response checklist is a detailed breakdown of which employees should be contacted and what they should do in the event of a disaster. These should cover everything from who phones your IT support company to who puts out the fire or organises the evacuation drill. Ideally, these responses should be practiced. It’s no good telling someone they have to turn off the building’s water in the event of a flood if they don’t know where to do that.

- Have a data backup plan

All company data needs to be backed up, as regularly as possible. How this is done will depend on how vital that data is to the operational capabilities of your business but should happen at least once a day. Look at your company carefully and decide which information is vital and which can safely be lost. You don’t need to back up all your client emails if you also keep other records of their projects for instance.

Data is a business asset and has real value. The more important the data, the more strictly and safely that data needs to be backed up. Can you do it yourself on a hard disk that the secretary takes home, or do you need a full-scale external, cloud-based solution?

- How are you going to tell your clients?

While it's usually a good idea to keep drama and difficulties far away from your clients, in this instance it may be important to tell them what is going on to explain any delays they may be about to experience and how you are planning to meet their orders. In addition, provide them with any alternate contact details.

Your plan should detail exactly how that is going to happen. Having pre setup and approved email addresses and telephone numbers organised will save a lot of time and frustration until your company is back on its feet.

- Cost considerations

Your plan should also take into account the cost considerations of setting things up anew. Will you need to buy new servers? Do you need to bring in IT experts to recover data? The money for this should be set aside and available as every day you delay your recovery is another step closer to bankruptcy.

Speak with your accountant as to how you can finance this fund, or whether insurance options may be a financially viable option for your company.

- Vital document and data storage

On top of all of this, your Disaster Recovery Plan should also detail where copies of all the most vital information will be stored and how they can be retrieved. This should be a safe and secure offsite location. Keys and access codes need to be kept in a third location as well.

|

|

Five Essential Bookkeeping Tips for Small Businesses

|

|

“Making good judgements when one has complete data, facts, and knowledge is not leadership - it's bookkeeping” (Dee Hock, Founder and CEO of VISA)

When running a small business, it often feels like you are doing everything yourself, and some important tasks can slip under the radar. One aspect that should never be forgotten though is bookkeeping. While intimidating, keeping your finances in order need not be as hard as it sounds. Here are our tips for ensuring your accounts remain ordered and your peace of mind intact.

- Ask your accountant

If you want to keep things as simple as possible and guarantee you never run foul of the law, getting your accountant in to do your bookkeeping is the safest and most efficient way to do your books. Apart from being able to manage your finances, an accountant would be able to help save on taxes and advise you on areas of the business that may be streamlined.

- Keep your personal and business accounts separate

It may not seem like much, but mixing up which account pays for what can lead to hundreds of extra hours of work over the course of a year working out which deductions and expenses relate to your business. Rather keep personal and business accounts and banking separate.

- Set up reminders for important deadlines

Using an online calendar, it’s now easy to set up reminders for all those important tax and other deadline dates so you know when things are becoming urgent.

- Keep receipts

Be sure to keep all receipts to build a verifiable audit trail. Whenever you pay anything out to a supplier it's important to get an invoice and file it away. Keep all your receipts for all business expenses and purchases. You never know when you may be hit with an audit and need to prove everything you have said.

- Keep reports

Every month generate a one-page document detailing all your income and expenditure. Ask your accountant to set up a simple monthly one-page report that, in addition, compares actual income and expenses to your budget. It doesn’t have to be detailed but should give you an idea of just where the money is going and what is coming in. As well as making bookkeeping easier, it will also help you track the growth and health of your company.

|

|

Effective 1 March 2023: New Earnings Threshold and National Minimum Wage

|

|

Employers and employees need to keep an eye on the annual increases in both the National Minimum Wage and the Earnings Threshold, summarised below for your convenience. Both are effective from 1 March 2023.

The National Minimum Wage increase

The National Minimum Wage (NMW) for each “ordinary hour worked” has been increased by 9.6% from R23-19 to R25-42. Workers who have concluded learnership agreements in terms of the Skills Development Act are entitled to a sliding scale of allowances.

Domestic workers

Domestic workers were brought into line with the NMW in 2022, and assuming a work month of 21 days x 8 hours per day, R25-42 per hour equates to R4,270-56 per month. The Living Wage calculator will help you check whether or not you are actually paying your domestic worker enough to cover a household’s “minimal need” (adjust the “Assumptions” in the calculator to ensure that the figures used are up to date).

The Earnings Threshold Increase

The annual earnings threshold above which employees lose some of the protections of the Basic Conditions of Employment Act has been increased by 7.6% from R224,080-48 p.a. (R18,673-87 p.m.) to R241,110-59 p.a. (R20,092-55 p.m.).

"Earnings" (for this purpose only) means “the regular annual remuneration before deductions, i.e. income tax, pension, medical and similar payments but excluding similar payments (contributions) made by the employer in respect of the employee: Provided that subsistence and transport allowances received, achievement awards and payments for overtime worked shall not be regarded as remuneration”.

Some employees enjoy only limited BCEA protection even if they earn below the threshold - notably any “senior managerial employee" (“an employee who has the authority to hire, discipline and dismiss employees and to represent the employer internally and externally”), any “sales staff who travel to the premises of customers and who regulate their own hours of work” and any “employees who work less than 24 hours a month for an employer”. Take specific advice for details.

The threshold also impacts on some of the protections provided in the Labour Relations Act –

- Employees earning less than the threshold, if contracted to a client for more than three months through a temporary employment service (“labour broker”) are deemed to be employed by the client unless they are actually performing a temporary service.

- Fixed-term employees earning below the threshold are deemed to be employed indefinitely after three months unless the employer has a justifiable reason for fixing the term of the contract.

Turning to the Employment Equity Act, employees earning over the threshold can only refer unfair discrimination disputes (other than disputes based on sexual harassment) to the Commission for Conciliation, Mediation and Arbitration (CCMA) with the consent of all parties. Otherwise, they must go to the Labour Court for arbitration.

|

|

Your Tax Deadlines for March 2023

|

- 7 March - Monthly Pay-As-You-Earn (PAYE) submissions and payments

- 30 March - Excise Duty payments

- 31 March – End of the 2022/23 Financial Year

- 31 March - Value-Added Tax (VAT) electronic submissions and payments & CIT Provisional payments where applicable.

|

|

Note: Copyright in this publication and its contents vests in DotNews - see copyright notice below.

|

| |

|

|

|

|