|

|

| |

|

January 2023

|

New Year, New Business - How to Pick the Right Legal Entity for It

|

|

“Owning one's own business is an adventure – enjoy it every step of the way.” (From the SME Toolkit article referenced below)

First, three questions to ask yourself…

If you dream of going into business for your own account in 2023, ask yourself these questions before you get started –

- Am I an entrepreneur? You have an amazing idea, you can’t wait to launch your new business, success and wealth beckon! But wait a second - are you really suited for the hurly-burly of entrepreneurship? It can be hugely rewarding, not just in the financial sense but also in terms of lifestyle and life satisfaction. But it also carries far more risk than the classic “9 to 5 employee” option, so think long and hard before choosing. There are many online quizzes to help you decide – try for example DeLuxe’s “Quiz: Are you ready to start your own business?” here.

- What’s my plan? Without a plan you sail rudderless through some very treacherous and shark-infested waters. Start-up failure rates are high, but luckily there is plenty of advice available to help you plan your course. Read for example the Business Partners “Ten Simple Rules For a Successful Start-up” on SME Toolkit.

- What legal entity should I use to trade? Don’t make the rookie mistake of setting sail in just any old boat. Starting off in the wrong entity and then having to change mid-stream will mean a lot of unnecessary expense, hassle and risk. Rather plan long term – ask yourself where you want your business to be in 5 or 10 years, how big it will be, what your exit plan will be and so on.

We set out below some brief thoughts on the various alternatives available to you, but upfront professional advice, specific to your particular needs and circumstances, is a real no-brainer here.

So, what are your choices?

…and four business vehicles to choose from

You have four main options –

- A sole proprietorship (“sole trader”). You are the business, trading for your own personal profit and loss, perhaps under a trading name such as “Syd Smith trading as ‘Syds Plumbing’”.

- A partnership of 2 to 20 individuals or entities, pooling resources to carry on a trade, business or profession for a share of the profits.

- A private company (“Pty Ltd”) with any number of shareholders. Controlled and administered by directors.

- A trust (number of trustees and beneficiaries not restricted). There are various types of trust, with trustees controlling and managing trust assets and/or trading for the benefit of beneficiaries.

Note that you might be advised to combine one or more of these entities in a corporate structure, and that there are other specialised types of entity available to, for example, non-profit organisations (charities etc), professionals (lawyers, accountants, doctors etc) and the like.

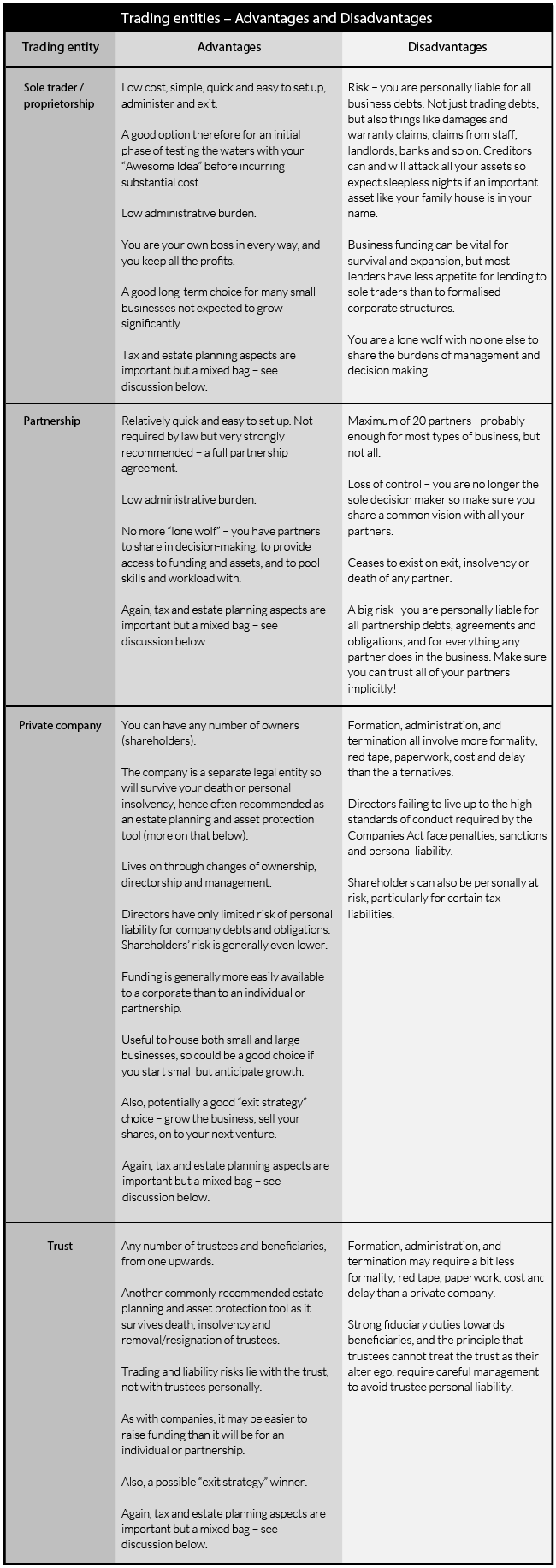

The pros and the cons of each

Have a look at the illustrative table below for a summary of the advantages and disadvantages of each of these options.

Don’t forget the tax and estate planning implications!

Each of your choices carries with it a mixed bag of positives and negatives when it comes to both tax and estate planning implications. For an overview, have a look at SARS’ “Starting a business and tax” webpage, with a link to its “Tax Guide for Small Businesses” PDF.

That Guide is 102 pages long, and unless you are comfortable with the complexities involved, professional advice specific to your circumstances is again essential.

In a nutshell –

- Estate planning: You may be advised to use companies and trusts for tax-efficient and practical transfer of wealth to future generations, as well as for asset protection from creditors both before and after you die. Both companies and trusts are “perpetual” in the sense that they survive changes in directors/trustees (resignation, removal, retirement, insolvency, death etc), with potential multi-generational savings in estate duty and avoidance of the cost and delays inherent in deceased estate administration.

- Tax efficiency: Sole traders and partners are taxed at individual rates; trusts other than special trusts at a flat rate of 45%; companies at a flat rate of 27% (27% for years of assessment ending on 31 March 2023 and later, previously 28%) with 20% dividends tax when you take profits out. There are a host of other factors to take into account here, including aspects such as Capital Gains Tax inclusion rates, exclusions, exemptions, small business breaks and the “trust conduit principle” all being highly relevant to the ultimate question – will you be better off being taxed as an individual or will some form of corporate and/or trust structure be more tax efficient for you?

Take that professional advice!

|

|

When Your Buyer Can’t Get Finance, Might a Kustingsbrief Save the Sale?

|

|

“A kustingbrief … has long been recognised as a superior front-ranking form of security.” (Extract from judgment referred to in the article)

You accept a great offer on your property, the sale agreement is signed and the buyer pays the deposit. You put the champagne on ice. But before you can pop it open, the buyer’s bond applications are rejected by every bank. Your sale is about to die. Is there anything you can do to rescue it?

The “kissing letter” option

A kustingsbrief (literally “kissing letter”) has its origins in old Dutch law and refers to a type of mortgage bond – a “purchase money mortgage bond” - registered in favour of a person or institution to secure the balance of the purchase price (or the full purchase price if no deposit is paid).

Many “bank bonds” and other third-party loans will fall into that definition, but in this article we’ll use the term only to refer to a bond in favour of the seller. For example, a buyer pays a R400,000 deposit on a R4m sale. The buyer can’t get a bank loan so the seller agrees to let the buyer take transfer in return for a bond in favour of the seller for the R3.6m purchase price balance. The buyer then takes transfer and pays off the bond in the same way that a bank bond would work, except of course that all payments go to the seller.

Have a look at the advantages and disadvantages of the concept below before considering this option.

Advantages

- The sale is rescued to everyone’s benefit.

- Interest on the monies due and the terms of repayment are fully negotiable (but note the warning to sellers under “Disadvantages” below).

- Because the bond must be registered in the Deeds Office simultaneously with transfer of the property, it gives the seller very strong security in the event of non-payment by the buyer. It is by definition a “first bond” so ranks ahead of any further bonds registered down the line.

- Even if the buyer’s estate is sequestrated within six months of the bond being lodged in the Deeds Office, this security remains strong. As our courts have put it: “A kustingbrief … has long been recognised as a superior front-ranking form of security.”

Disadvantages

- Assuming the bond carries interest, the seller would probably be wise to register as a credit provider. There are exceptions and grey areas here - for example, lending money to a dependant family member might be exempt, and there are limited exceptions applying to “juristic person” consumers. But if the seller should have registered as a credit provider and failed to do so, the whole deal is invalid and unenforceable, and that will leave the seller unable to claim a cent and in fact having to repay any instalments already paid.

- The seller must be in a financial position to wait for full payment. And whilst being paid in monthly instalments for say 15 or 20 years will be perfect for some sellers, most are more likely to need full payment against transfer.

- In practice, other than perhaps where close family is involved, the seller is likely to need a lot of convincing about the buyer’s creditworthiness if no bank will grant a bond. Most sellers will be reluctant to go this route without some form of comfort such as a larger-than-normal deposit, third party suretyships or some other avenue of recovery should the buyer default on instalments down the line.

- The seller will have to administer the process of collecting instalments and so on, for as many years as the agreed term of the bond.

All that said, in the right circumstances this option could be the saving of a great sale. It goes without saying that full advice specific to the circumstances is absolutely essential here.

|

|

Living Wills: 6 Myths Busted

|

|

Health issues and mortality are facts of life, no matter how remote they may seem at the moment, nor how distressing they are to contemplate. For your family’s sake as well as for your own, make sure that you have a Living Will (or another form of “advance healthcare directive” such as a Durable Power of Attorney for Healthcare) in place. While you’re at it, check that your loved ones also make Living Wills.

6 Myths

Let’s get some pervasive myths about Living Wills out of the way. In doing so we’ll answer the question of why everyone, young and old, should have one.

Myth 1: “It’s not important, I already have a will”. Not true, your “Last Will and Testament” is another concept altogether. Certainly it’s a vital document, quite possibly the most important one you will ever sign, but it talks only as to what happens after you die. It won’t help you before you die.

In contrast, a Living Will applies while you are still alive, setting out what medical treatment you do and don’t consent to. It speaks for you when you can no longer speak for yourself. It addresses your right to decide whether or not you are to be kept artificially alive after you lose the capacity (physical or mental) to object.

Myth 2: “It’s euthanasia or assisted dying”. No, it’s a totally different concept. Euthanasia and “assisted dying” (or “medically assisted suicide”) are unlawful in South Africa. But your Living Will does not instruct doctors to actively intervene to end your life nor to assist you in committing suicide. In fact, it does the opposite, instructing that nature be allowed to take its course and refusing any active intervention to keep you alive artificially (possibly in pain and distress) after all hope of recovery has gone.

We must all decide for ourselves the extent to which we are comfortable with this concept. Discuss any conscientious or religious concerns with your spiritual advisor if you have one.

Myth 3: “It’s selfish”. In no way is it selfish. It helps your loved ones make the hard choices if and when they are called on to do so, and it spares them the distress of feeling responsible for making life and death decisions for you at the worst possible time. You relieve them of that burden by telling them what your decision is. It could also save your family a fortune in crippling and totally unnecessary medical expenses.

Myth 4: “It won’t be honoured so it’s pointless”. Advance healthcare directives have to date neither been specifically recognised in law, nor held unenforceable by our courts or legislation. A large body of opinion suggests that they can and will be enforced because of the general rule that patients must consent to treatment. Both the HPCSA (Health Professions Council of South Africa) and SAMA (South African Medical Association) have issued guidelines for honouring advance directives, with medical practitioners called upon to encourage their patients to put directives in place.

Myth 5: “It can wait until tomorrow”. No, it can’t. The most settled of lives can be upended in the blink of an eye. Traffic accidents, strokes, sudden onset illnesses (think covid!) and the like often don’t announce themselves at all.

Myth 6: “I’m too young to need one”. Nope. Those horror scenarios we mentioned above come out of the blue to young as well as to old. Express your wishes while you can – it’s too late afterwards.

What should be in your Living Will and who should you give it to?

There is no set format here but several standard templates are available. If you are given one or get one online, it’s important to have your lawyer configure it to set out clearly and lawfully your own specific needs and wishes, consistent with any religious or moral beliefs you may hold. This is your chance to set out what you want. Make it easy for your loved ones and healthcare workers to honour those wishes - don’t for example ask a doctor to actively end your life, that’s illegal.

Sign several originals, keep one for your own use and give the others to your loved ones, your healthcare practitioners, your lawyer and anyone else who might end up having to implement it or oversee its implementation (a close friends perhaps, or a retirement facility if you live in one).

Diarise to review and renew it regularly – the attending doctor must be satisfied that you were mentally competent when you signed the directive, and that your wishes haven’t changed in the interim.

What about a “Durable Power of Attorney for Healthcare”?

This is a document (also as yet untested in the courts) in which you appoint someone you trust, normally a close family member, as your substitute healthcare decision-maker should you become unable to make your own decisions. It’s a very personal decision whether to go with this concept or to just stick with a Living Will, but you could perhaps have both - a Living Will plus a power of attorney authorising your decision-maker to ensure that it is implemented.

|

|

“Double Jeopardy” for Tax Evasion – Penalties plus Prosecution

|

|

“Administrative penalties and criminal proceedings do not serve the same purpose. The [one] is aimed at strengthening internal controls of the administrative authority and to promote compliance while the other is aimed at correcting a behaviour that caused harm to the society.” (Extract from judgment below)

SARS has announced major crackdowns on tax defaulters, and a recent High Court decision highlights the dangers of being caught out for “intentional tax evasion”.

R1.3m prejudice to SARS

- A close corporation (CC) registered for both income tax and VAT (value added tax) rendered “nil” returns to SARS over a four-year period, indicating that no income had been generated and no expenses incurred.

- After a tax audit, SARS determined (and the CC admitted) that the returns were false and that SARS had in consequence suffered prejudice of R819,607 on VAT and R493,600 on Income Tax.

- SARS levied 10% late payment penalties and further imposed a 150% understatement penalty on both Income Tax and VAT. The 150% was imposed for “intentional tax evasion”.

- Both the CC and the member were then also charged criminally for intentional tax evasion.

Both penalties and prosecution – is that “Double Jeopardy”?

They applied to the High Court for a declaration that the relevant sections of the Tax Administration Act are invalid, arguing that it is inconsistent with the constitution to “criminally punish the taxpayer twice for the same criminal offence of intentional tax evasion.”

Which raised the question of whether or not this was a case of “double jeopardy” - the legal rule that “no one may be punished for the same offence twice.” You cannot, in other words, be repeatedly prosecuted for the same offence.

But, held the Court, “nothing precludes civil administrative proceedings and criminal proceedings from the single act”. Double jeopardy does not apply in a case such as this where “calling the taxpayer to account for the wrongdoing before an administrative body as well as the criminal are two distinct processes”.

In other words, both the CC and the member, having been subjected already to hefty administrative penalties (that 150% understatement penalty must hurt particularly badly!) now face criminal prosecution as well. Criminal records, substantial fines and direct imprisonment are all on the table.

|

|

Websites of the Month: Community Schemes - “CSOS Connect” Services Going Live

|

|

If you are in a Community Scheme such as a Sectional Title development or a residential complex with a Homeowners Association (HOA), keep an eye on the “Shared Living” magazine from the CSOS (Community Schemes Ombud Service) on its Newsletter page. Most of the articles are clearly aimed at Bodies Corporate, HOAs and Managing Agents, but owners and tenants will also find value in many of the topics covered.

Click on Issue 19 (October – December) here and go to page 7 for a short presentation (keep your speakers on) on CSOS Connect’s online services. As at date of writing, only some services are already live, with a full roll-out planned for early 2023. Hopefully interacting with CSOS is about to become a lot better and easier!

|

|

|

Have a Healthy,

Happy and Successful

2023!

|

|

|

Note: Copyright in this publication and its contents vests in DotNews - see copyright notice below.

|

| |

|

|

|

|