|

|

| |

|

September 2024

|

Beware the Taxman When Accessing Your Three-Pot Retirement Savings!

|

|

“The two-pot system is meant to support long-term retirement savings while offering flexibility to help fund members in financial distress.” (National Treasury)

With two new pots added to what used to be the one-pot South African retirement system, fund members can now access a portion of their retirement savings before retirement, while still preserving savings for retirement. There are, however, immediate and long-term tax and other implications that should be carefully considered!

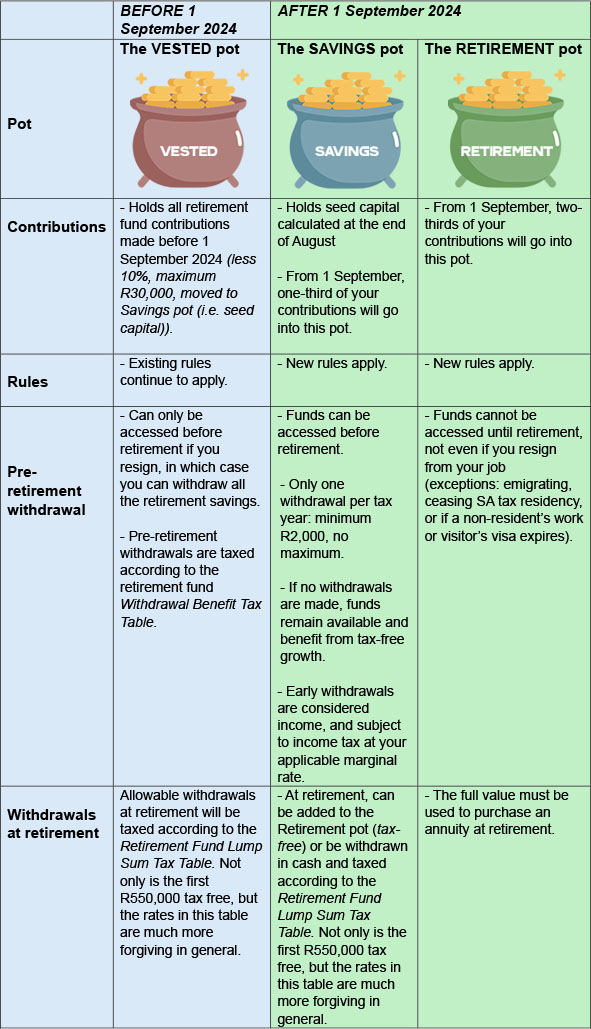

The three pots of the new retirement system

Tax and other issues

Withdrawing from any of the pots should be approached with caution. In addition to the fees that will be charged, and the potentially devastating impact on your eventual retirement savings, there are also tax implications that must be carefully considered.

- It’s significantly more expensive from a tax perspective to withdraw retirement funds before retirement age (normally 55), because the Withdrawal Benefit Tax Table or Individual’s Tax Table will apply. Instead, waiting until retirement to access savings – when the Retirement Fund Lump Sum Benefits or Severance Benefits Tax Table applies – is a far better tax option.

- Up to R550,000 drawn as a cash lump sum at retirement may be tax free. However, this R550,000 is a cumulative withdrawal total over your lifetime. That means this tax benefit could be eroded by pre-retirement withdrawals.

- Transfers from the Vested and Savings pots into the Retirement pot are also tax-free.

- Employer contributions are still treated as taxable fringe benefits.

- Early withdrawals from your Savings pot are considered income and are subject to income tax as per the tax directive the fund manager will request from SARS. What’s more, any outstanding taxes you owe SARS will automatically be deducted if you make a withdrawal.

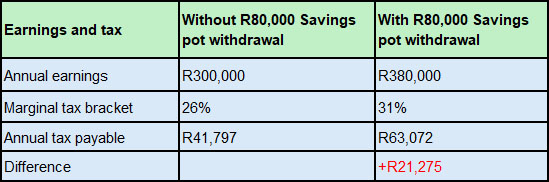

- Depending on your annual income and the amount withdrawn, a pre-retirement withdrawal from your Savings pot – taxed at your individual marginal tax rate – could also push you into a higher tax bracket. This would mean paying more tax on all your income for the year. Here’s an example of the potential impact of withdrawing R80,000 from your Savings pot. Waiting until retirement age to withdraw the same amount could be tax-free.

Hidden costs of early withdrawals

Your full retirement fund contribution (one-third Savings pot; two-thirds Retirement pot) is still tax deductible up to 27.5% of annual income, up to a maximum R350,000 per tax year. This remains one of the biggest tax breaks out there, but is effectively cancelled out by the tax payable on an early withdrawal. Early withdrawals also have another cost – the loss of tax-free growth that could have been earned on your savings.

Continuing with the example above, if the R80,000 is not withdrawn, but instead left to grow at an average annual return of 10% for 25 years, the projected returns are R866,776 (equivalent to R201,958 in today’s terms assuming 6% inflation). This means you could lose tax-free growth of R121,958 by withdrawing just R80,000!

Help is at hand!

Understanding the tax and other implications of early retirement fund withdrawals in the short term and at retirement will help you to make better-informed financial decisions.

Early retirement fund withdrawals are likely to be more expensive in tax and lost investment growth compared to other options such as overdraft facilities, credit cards or home loans.

Please talk to us if you or any of your employees are considering retirement fund withdrawals. We’re here to help!

|

|

5 Top Tips for Managing Debt in Your Startup

|

|

“There are no shortcuts when it comes to getting out of debt.” (Dave Ramsey, finance journalist and author)

Most businesses have debt of some kind or another. Whether you need help to buy stock, maintain equipment or even fund a property, it’s likely that at some stage in your business’ life you will need to take out loans. The challenge comes in balancing the needs of your business with the debt you’ve taken on in a way that ensures growth. Here are our five tips for managing debt in your startup.

- Understand your debt

In order to successfully manage debt, you first need to fully understand it. As your accountants, we can help you create a complete spreadsheet of your debts detailing everything from the amounts owed, to interest rates, repayment schedules, and even penalties that may be triggered by late payments. This information will be critical for making the right choices.

- N is for negotiate

Provided you have a good relationship with your lenders, your next step should be to try to renegotiate all your loans. Asking for lower interest rates, extended repayment terms or consolidation of debts could make the whole process of debt repayment simpler.

- Not all debts are created equal

With your debts now in their healthiest place, it’s important to recognise that some debts are more important than others and thus need to be paid off first. Generally, you should aim to pay off high-interest loans first as these will cost you the most in the long run. Next you need to cover any debts which are secured by collateral – this will stop you from losing your assets in the future. Tax debts should also be prioritised as these can come with severe penalties and even criminal prosecution.

Sometimes the choices are not immediately obvious, so don’t be afraid to ask us for a debt repayment schedule which factors in your business’ operating conditions, cashflow and ultimate goals.

- Improve cash flow

If you want to make sure your debt never becomes a problem, it’s vital that you improve the cash flow in your business to the point where you can meet your obligations. This can happen either through increasing sales, decreasing costs, or optimising operations – or from a combination of all three. For example, any money you can save on unnecessary expenses can go towards repaying your debt, lowering your interest payments and ultimately increasing the likelihood of success. It’s therefore essential that you work with us, your accountants, to optimise your inventory, cut costs, improve sales opportunities and chase your debtors and invoices to ensure prompt payment.

- Monitor your debt carefully

Your repayment schedule should not be set in stone. It needs to be reviewed and adjusted regularly to account for any changes in your business condition. The goal here is not to be entirely free of debt, but rather to leverage debt for improved business growth. Managing debt is an ongoing process that could very likely last for the entire lifespan of your company.

The bottom line

Debt can be the leg-up your business needs – or the lead weight that holds it back. Speak to us to make sure it’s the former.

|

|

Is it Possible To Run a Successful Ethical Business?

|

|

“It takes 20 years to build a reputation and 5 minutes to ruin it. If you think about that you will do things differently.” (Warren Buffett)

During tough economic times it can be tempting to illegally cut corners, hire staff at lower salaries, or avoid paying taxes you know you should be paying. The unethical approach can be very tempting if you find yourself battling to keep your business going. Taking the low road, would, however, be the wrong choice.

An ethical business is one that’s transparent and honest about everything from its accounting practices, to its treatment of employees, interactions with the public, and the information it shares with shareholders. Truly ethical companies put the wellbeing of their customers and employees on par with profits. Now, backed by repeated studies, the financial experts agree that running a business ethically isn’t just better for a business’ short-term success, it’s also far more profitable in the long run. But why?

Consumers demand ethical management

With climate change at the forefront of every modern consumer’s thinking, the demand for sustainable, and ethical business practices has never been higher. Company business practices are now easier to scrutinise and more consumers are taking an active interest in the ethical aspects of the companies they deal with. In short, customers want to buy from ethical businesses.

A recent study into consumer intent carried out by OpenText found that 88% of global consumers surveyed would rather buy from companies with ethical sourcing structures in place and that 83% of global respondents said they’d be willing to pay more for products they could be sure were ethically sourced.

The trickle-down effect

Moral and ethical business leadership has also been shown to reduce friction in teams and allow employees to better focus on their jobs. In a recent study, researchers at the University of Lahore revealed that supervisors who act ethically are more trusted by their employees and that this trust translates into boosted productivity from staff who are both more engaged and less emotionally exhausted. According to Gallup, teams which are highly engaged are, on average, 21% more productive and 28% less likely to steal from the company.

Big Brother is watching

When Volkswagen was ordered to pay back R201-billion to customers in the US who had been sold cars with falsified emissions data in 2015, the writing was on the wall for companies hoping to save money through unethical behaviour. In South Africa, you don’t need to look far for examples of large companies being brought to their knees by the unethical finance decisions of the boards. Steinhoff and Telkom have suffered for their questionable finance decisions and abusing their industry dominance respectively. And a R4.1-billion fine was issued to global software company SAP around bribes paid to South African and Indonesian officials to obtain valuable government business.

The truth is, regulators are looking at companies harder than ever before, and those who think they can slip through the legal cracks are increasingly finding themselves coming up short.

Being ethical will actually save you money

While many think ethical behaviour may cost more, there are multiple examples where “doing the right thing” has in fact led to a decrease in the cost of production. For instance, both PepsiCo and Hilton Worldwide have reported that their energy and waste-reduction strategies have resulted in billions of dollars in savings.

Onwards and upwards

Without a doubt, these are powerful incentives, and similar benefits can also be found for your company. Whether you want to install solar power to go greener and save money or ensure you never fall foul of obscure financial regulations, as your accountants, we are always ready to help.

|

|

How to Survive Trust Tax Season 2024

|

|

“A Trust is a ‘person’ for tax purposes and is therefore a taxpayer in its own right.” (SARS)

With Tax Season 2024 for trusts opening on 16 September, there’s no better time to draw trustees’ attention to SARS’ continued emphasis that all trusts must register for income tax purposes, including dormant trusts. Once registered, trusts are obligated to submit income tax returns that are aligned with other trust reporting requirements from SARS and substantiated by extensive supporting documents and information.

Trustees are held responsible for non-registration of trusts for income tax, and they will not be able to evade enforcement actions by blaming third parties for failing to file returns. “But I didn’t know I was meant to,” is not a valid excuse.

Trust tax returns can be filed from 16 September 2024 (much later than the usual June/July opening) until 20 January 2025.

Along with the new filing season dates, trusts also face several onerous compliance requirements – and some stiff potential penalties.

Onerous requirements

- SARS introduced changes to the Income Tax Return for Trusts (ITR12T) last year, with additional probing questions, and even more mandatory supporting documents.

- The range of mandatory and supporting documents that must be submitted with the ITR12T depends on the trust type, and may include:

- All certificates and documents relating to income and deductions

- Trust Deed and Letters of Authority

- Resolutions/minutes of trustee meetings

- Details of the 'Main' Trustee (the SARS registered representative)

- Financial statements and/or administration accounts

- Particulars of assets and liabilities

- Confirmation of banking details

- Proof of payment of any tax credits

- Supporting schedules

- Detailed disclosure of the beneficial ownership, including the submission of identity documents of all beneficial owners. This information will be checked against the beneficial ownership register lodged with the Master of the High Court. Non-compliance could result in a trustee receiving a fine of up to R10 million, a prison sentence of up to 5 years – or both.

- To provide SARS with a clearer understanding of the assets, income and activities within trust structures, trust returns now feature additional questions such as any local or foreign amounts vested in the trust as a beneficiary of another trust.

- Information reported on the trust tax return must also align with the IT3(t) reporting of prescribed information by trusts, now also mandated by SARS. It includes trust distributions and their beneficiaries, trust and beneficiary demographic information, trust financial flows, and amounts vested in a beneficiary, including net income, capital gains and capital amounts. The first IT3(t) certificates are due to be submitted at the end of September 2024 for the 2023/24 tax year, and then on an annual basis.

- Despite the above reporting deadline, SARS confirmed that trust beneficiary income tax returns will not be pre-populated with IT3(t) data for the 2024 year of assessment. This means trustees must also provide details of trust beneficiaries’ 2024 trust earnings timeously to the beneficiaries for inclusion in their personal income tax returns, for which the submission deadlines remain unchanged despite the change in the trust tax filing season.

We can help you survive Tax Season 2024!

Without professional assistance, surviving trust Tax Season 2024 would be a tough ask. The complexity of the processes and the new requirements exponentially increase the risk of errors. And that’s before you factor in the significant time required to manually upload the extensive list of supporting documents – especially in light of SARS’ increased efforts to improve tax compliance and the severe penalties for non-compliance.

Luckily, you can rely on our friendly, professional assistance to ensure all the compliance boxes are ticked and penalties are avoided this trust Tax Season.

|

|

Your Tax Deadlines for September 2024

|

- 06 September – Monthly Pay-As-You-Earn (PAYE) submissions and payments

- 16 September – Start of Filing Season 2024: Trusts

- 25 September – Value Added Tax (VAT) manual submissions and payments

- 27 September – Excise duty payments

- 30 September – VAT electronic submissions and payments, Corporate Income Tax Provisional Tax payments where applicable, and Personal Income Tax Top-up Provisional Tax payments.

|

|

Note: Copyright in this publication and its contents vests in DotNews - see copyright notice below.

|

| |

|

|

|

|