|

|

| |

|

December 2022

|

Selling Property this Festive Season: The Tax Angle

|

|

December and January have always been prime months for selling residential property in South Africa, and if you are a “Festive Season Seller”, here are two really important tips for you.

- Plan your finances

Understand and plan for all the financial implications, not just the legal ones.

Prepare a cash-flow forecast so that you know what you will receive and when, and what you will have to pay and when. Your forecast will tell you what funds you must have available at all stages of the sale and transfer process, and it will answer your bottom-line question – what will be left in your pocket at the end of it all?

- Don’t forget your CGT liability

There are many expenses you should provide for (ask your lawyer to help you list them), but in this article we’ll only address one of them - the CGT (Capital Gains Tax) aspect.

This is vital – if you made a “capital gain” on the sale (more on how to calculate that below) you could be liable to pay CGT. If so, it could well be a substantial liability, and not planning for it will leave you in a world of pain because if you can’t pay your tax bill SARS will be after you with a big stick (SARS has extensive powers when it comes to debt collection).

There is a bit of good news: The advantages of owning your own family home, and the value of property generally as an investment channel, will for most people outweigh the pain of having to pay tax when you eventually sell. Plus, as we shall see below, paying CGT on a property sale is not nearly as painful as it would be to pay income tax on it. Indeed, if the capital gain on your primary residence is R2m or less, your CGT bill is nil!

How does CGT on a property sale work?

This is a complex topic, so what follows is of necessity a summary of general principles only – there is no substitute for specific professional advice here!

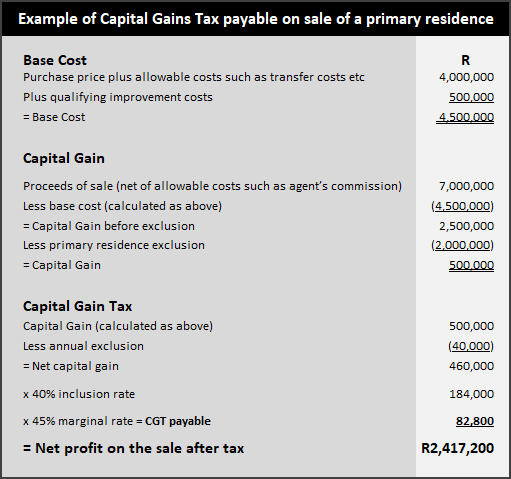

- What is Capital Gains Tax? CGT forms part of your income tax and is a tax on any “capital gain” you make on an asset, in this case a property. The capital gain is the difference between your base cost and the proceeds of your sale.

- What is “base cost”? This is what your property cost you to acquire (including transfer costs, transfer duty and the like) when you bought it. Note that CGT only kicked in on 1 October 2001, so if you bought the property before then it is the property’s value at that date that you will use. Qualifying improvement costs (extensions, additions and the like but excluding maintenance or repair costs) are also added to your base cost, so keep a separate note and proof of these as you incur them over the years. Our example calculation below assumes a homeowner who bought a number of years ago for R4m inclusive of transfer costs and duty, then spent a total of R500k on improvements (perhaps adding an extra room and a swimming pool).

- How do you calculate the “sale proceeds”? From the sale price you can deduct any costs of selling which are directly related to the sale, such as agent’s commission, advertising, legal costs and so on. In our example we assume net sale proceeds of R7m.

- How do you calculate the “capital gain”? This is the difference between the base cost and the proceeds of the sale (R2.5m in our example, before the primary residence exclusion).

- What can you deduct from the capital gain? If the property is in your personal name and is your “primary residence” (i.e., where you normally live) you can deduct a R2m exclusion from the capital gain. Note that if you used your house for business purposes or if you didn’t reside in it for the whole period of ownership, you need to take specific advice on how much (if any) of the exclusion is available to you. You can also deduct an “annual exclusion” of R40,000. In our example we assume the seller is entitled to both exclusions in full, resulting in a net capital gain of R460,000.

- How are you taxed on the net capital gain? The example below will help clarify this. Your capital gain is added to your annual income tax liability at the “inclusion rate” applicable to you. Individuals and special trusts have an inclusion rate of 40%, whereas other trusts and companies have an inclusion rate of 80%. You will then pay tax on that amount at your marginal tax rate (18% - 45% depending on your taxable income). In our example we assume an individual taxpayer paying tax at the highest marginal rate of 45%, the resulting tax liability of R82,800 amounting to just under 1.2% of the net sale proceeds. Our seller’s profit on the sale net of tax would then be R2,417,200.

So how much CGT will you actually pay?

For an individual your calculation is: Capital Gains Tax = Capital Gain x 40% inclusion rate x your marginal tax rate.

Have a look at the example below which assumes an individual home seller entitled to the full R2m primary residence exclusion and paying tax at the highest marginal tax rate of 45%. Then use your own figures and make your own calculation.

(Source: Adapted from SARS examples)

|

|

Generational Wealth Planning - To Your Children and Beyond!

|

|

“Are we being good ancestors?” (Jonas Salk)

What do you plan to give your family this Festive Season? Now’s the time to think beyond the brightly wrapped gifts under the tree and get started on an estate plan which will leave your loved ones the lasting gift of financial freedom.

Estate planning involves a lot more than just executing a valid will, but let’s start off with a reminder that a will must always be your top priority.

Your will is the heart of your estate plan

You will have heard this many times before, but it bears repeating. Your will (“Last Will and Testament”) could well be the most important document you ever sign. Without executing a will, you forfeit your right (and duty) to decide how your assets will be distributed so as to ensure the future happiness and well-being of your loved ones. You lose your opportunity to choose an executor you can trust to wind up your estate professionally and efficiently. And no matter your age or state, it cannot wait – no one knows when the fateful day will dawn.

Most importantly, your will lies at the heart of your entire estate plan. It underpins and powers it. So, if you don’t yet have a will in place (or if your will needs updating) make your number one priority: “Book an appointment with my lawyer. Now.” Then ask your lawyer to draft your will to form the core of your overall estate plan.

What is an estate plan and why should you have one?

Your estate plan is your roadmap to creating wealth, to protecting it, and to transferring it to the next generation (or beyond). It is the only sure-fire way of ensuring your own comfortable retirement and of providing for the financial wellbeing of your loved ones after you are gone.

It incorporates your overall financial strategy, answering questions such as how you will save and invest, what investment options you will choose, how you will acquire assets, how you will provide for tax and other liabilities, how you will ensure effective succession planning in your business, how you will transfer your wealth to the next generation and so on.

Bring your family in early

It’s never easy contemplating one’s own mortality but in fairness to your loved ones make sure that as soon as they are old enough to participate, everyone is part of the process. Bring them in on everything you can and keep them in the loop when you are tracking progress or thinking of changing anything.

Questions to ask yourself

As the old adage has it “Failing to plan is planning to fail”. So plan. Start by asking yourself (and your family) these questions –

- What is our end goal?

- How much wealth do we need to build up?

- What is our target date for reaching that goal?

- How will we achieve it?

Now formulate your financial mission statement

Use your answers to those questions to formulate a “financial mission statement” and a detailed strategy to get there. As always with goal setting, break the big goals down into little ones, with target dates for achieving them and ways of tracking your progress.

Done and dusted! But wait, how will you actually transfer that wealth to the next generation (or beyond)?

Preserving your wealth for the next generation – and beyond

For many, it’s only realistic to plan one or two generations ahead. But whether your aim is to provide financial cover for just your spouse and children, or for your grandchildren as well, or (let’s aim high here!) for your great grandchildren and beyond, your estate plan should lay out a clear strategy for preserving your wealth down the generations.

Trusts are often recommended for generational wealth preservation and transfer, and whilst they have pitfalls and should only be considered with professional advice, they can certainly provide a powerful solution. In particular they could result in substantial estate duty savings for many generations down the line. Similarly, corporate structures (companies, company/trust combinations and the like) are often used for this purpose, particularly when trading businesses are involved. Donations during your lifetime may be suggested but beware the tax implications. Living annuities enable you to nominate beneficiaries to receive the benefits (with a tax incentive for them to leave at least part of the funds invested). There may be other niche solutions to suit your particular needs.

The bottom line

There are many complex decisions to be made and there is no “one size fits all” solution. Every family’s situation and needs will be unique. Every class of asset and every wealth-transfer vehicle carries with it particular requirements, benefits, risks and cost and tax considerations.

Professional advice specific to you and your family is essential!

|

|

A “Running Down” Damages Claim – Elite Athlete v Happy Snapper

|

|

“This is a running down case: literally” (Extract from judgment below)

The scene is Cape Town’s iconic Sea Point Promenade. An elite runner participating in a race knocks down a pedestrian out for a Sunday walk, causing serious injuries. The pedestrian sues both the runner and the race organiser for damages of R718,000.

The outcome is another reminder to us all to be aware of our surroundings at all times – a moment’s inattention can change everything in a split second. As the facts here illustrate...

The race-day collision and the R718,000 claim

- Although the Court heard conflicting evidence as to detail, the setting for this unfortunate collision was common cause. A popular public space on a Sunday, replete with not only the normal pedestrians, cyclists, dog walkers and kite-flyers, but on this particular day also thousands of participants in a “Ladies Race”, ranging from athletes competing in an “elite race” to costumed “Fun Walk” entrants.

- Going for a Sunday stroll with a friend and “in the wrong place at the wrong time” whilst blissfully unaware of the misfortune about to be visited upon her for her act of goodwill, the claimant happily consented to a request from a group of “Fun Walk” participants to take a “happy snap” of them.

- Picture taken, she moved across the sidewalk to hand the camera back to its owner and a participant in the “elite race” ran straight into her, then ran off to finish her race.

- Suggestions that the runner (approaching it seems at about 20 kph) shouted a warning to the effect of “get out of my way” and forcefully pushed the claimant aside were in dispute, but what was clear was that she was knocked to the ground and sustained a hip injury which resulted in an ambulance trip to hospital and hip replacement surgery.

- The claimant sued both the runner and the race organiser for R718,000 in damages. The Court’s findings hold lessons for us all.

The race organiser off the hook

On the evidence, the race organiser and the race Marshall in the vicinity of the collision were cleared of any negligence.

The runner’s negligence

The runner, found the Court, was in a public space and should have been alive to the possibility of encountering other sidewalk users at close quarters. She had a duty to keep a proper look out and should have taken into account “the nonchalance and lack of interest of ordinary pedestrians who were out and about enjoying the fresh air rather than watching an athletics race. Ordinary human experience tells one that such persons might behave irrationally and get in the way, as it were.” (Emphasis added).

The runner was negligent in focussing only on the ground immediately ahead of her, “running as if in a bubble, oblivious to what was happening around her and intent only on achieving her goal of winning the race.” She could have avoided the collision with little effort and without seriously affecting her chances in the race.

The pedestrian’s 70% contributory negligence

However, in all the circumstances the Court held that the claimant (actually the executor of her estate as she had later died from unrelated causes) was only entitled to 30% of whatever damages could be proved.

She had been, said the Court, considerably more negligent than the runner. She had to be aware of the race, she knew runners were “whizzing” past her, and she had been warned of runners coming through.

The old ironic saying “no good deed goes unpunished” springs to mind, but the hard fact (in life as in law) is that we are often the architects of our own misfortune.

Be aware of your surroundings at all times!

It’s a hard lesson, but the law holds us to certain standards, and one of those is to keep a proper look out, particularly when in a public space. A moment’s inattention, and in a split second your life could change forever, with physical injuries compounded by the risk of damages claims and counterclaims of contributory negligence.

Take legal advice immediately if you are unlucky enough to be involved in an incident causing injury or other loss!

|

|

Employers: Don’t Miss Your Employment Equity Report Deadline!

|

|

Before you close up for the year, remember that if you are a “designated” employer, your Employment Equity Act (“EEA”) Report is due on 15 January 2023.

Failure to comply carries substantial penalties so don’t miss this deadline.

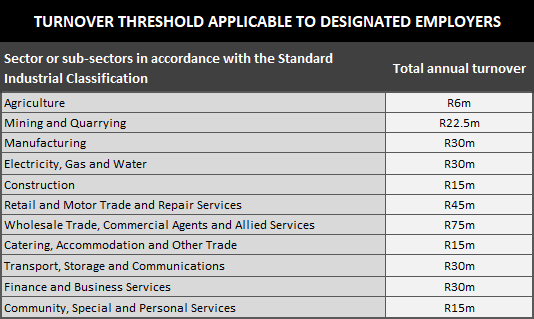

You are likely to be a designated employer if either –

- You have 50 or more employees, or

- Your annual turnover equals or exceeds your particular industry’s threshold. See the table below for details.

(Source – Schedule 4 to the Employment Equity Act)

There’s good news for some SMEs in the pipeline

Good news for smaller businesses drowning in red tape it that it seems likely that the threshold test will fall away at the end of September 2023. If you have less than 50 employees, that would let you off the reporting hook from October next year. But for now, if you are in the turnover net, meet the 15 January deadline.

Bear in mind also that all employers, designated or not, must comply with the EEA’s strict prohibitions against unfair discrimination.

|

|

Website of the Month: Don’t Stress this Silly Season!

|

|

"You can tell a lot about a person by the way they handle three things: a rainy day, lost luggage and tangled Christmas tree lights." (Maya Angelou)

December holidays are a time for winding down, recharging your batteries and sharing some quality family time. But it can also be stressful. There’s a reason we often talk about the “Silly Season”.

Don’t let the pressure get to you! Relax, take a deep breath, and read “10 tips to reduce festive season stress” on the Lionesses of Africa website.

Whatever else you do, enjoy your break!

|

|

|

Thank you for your support in 2022.

Have a Wonderful Festive Season, and a Happy and Prosperous 2023.

Enjoy the Break!

|

|

|

Note: Copyright in this publication and its contents vests in DotNews - see copyright notice below.

|

| |

|

|

|

|