|

|

|

|

|

|

|

|

Tax Season 2023 Now Open – What’s New and What’s Not

|

|

|

The 2023 Tax Season in South Africa opened officially on 7 July 2023 for individuals who are both non-provisional taxpayers and provisional taxpayers – as well as for trusts.

While much has stayed the same from last year, like the auto assessments introduced in 2022, there are also a number of changes this year – ranging from new deadlines to revised requirements briefly overviewed in the article – which taxpayers should take heed of before proceeding and which provide good reason for speaking to your accountant before submitting your tax for this year’s filling season.

|

|

|

|

|

|

|

|

|

The True Cost of an Employee

|

|

As they develop, businesses often need to take on new employees. The decision as to whether to do so will come down to business needs and the potential for growth compared with the cost of that new employee. Unfortunately, newer business owners can often hugely underestimate the true cost of that employee.

Monthly wages are just the first consideration when costing a new employee in this critical equation. Here are the things you need to factor in to work out the true cost of an employee.

|

| |

|

|

|

|

|

|

Tips for Getting out of Business Debt

|

|

As a business grows, owners may find they need to take out loans to build infrastructure, take on essential new employees, meet legal requirements or upgrade equipment to ensure future growth.

These moments can each feel necessary at the time, but if business owners are not careful, they may find themselves with more debt than they can reasonably manage. An inability to repay debts is a huge threat to business stability, and in the end, viability. Here are nine tips on how to get out from under crippling business debt.

|

| |

|

|

|

|

|

|

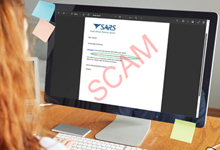

SARS Warning: Beware Scam Emails!

|

|

South Africans are expecting to hear from SARS, with Tax Season 2023 open since 7 July. Knowing this, cybercriminals will also be intensifying their email “phishing” attacks by sending emails that seem to come from SARS – often apparently notifying you of a tax refund or scaring you with outstanding debt or penalties – created to trick people into clicking on a link, sharing one-time pins (OTPs) or providing personal details.

Read on for more detail, advice on keeping safe, and useful links…

|

| |

|

|

|

|

|

|

|

|

|

|

Disclaimer

|

The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

|

|

© DotNews. All Rights Reserved.

|

A Client Connection Service by

DotNews |

|

|

|