|

|

|

|

|

|

|

| September 2017

NEWSLETTER

|

|

Directors’ Meeting Minutes: Why Are They So Important?

|

|

Directors must be constantly aware of their risk of personal liability if they fail to fulfil their fiduciary duties in compliance with the Companies Act.

Directors’ meetings are critical in this regard, and we discuss what is required in terms of minutes to be kept, what they must contain and why they are so important.

We also look at the golden rules of minutes - the “5Ws” (“Who?”, “What?”, “Where?”, “When?” and “Why?”), with a closing comment on the balancing act between transparency and confidentiality.

|

|

|

|

|

|

|

|

|

Your Will: The Master of the High Court Wants Qualified People to Assist “Lay” Executors

|

|

One of the vitally important issues you should consider when drawing your will is who to appoint as your executor. Should you nominate your spouse? Your children? A trusted professional?

We consider the Master of the High Court’s requirements in this regard and discuss how you can reduce delay and unnecessary extra cost in the winding up process by proactively planning how your chosen executor should meet these requirements when applying to the Master for appointment.

|

| |

|

|

|

|

|

|

SARS’ Plans to Tax Income Earned Abroad

|

|

If you are a South African tax resident and work abroad for 183 days or more (of which 60 days must run consecutively) in a year, you are not taxed locally on your foreign based earnings. Salary packages are often designed around the resulting reduced tax payable by employees on the overseas portion of their earnings.

Treasury has however released draft legislation which if adopted will repeal this exemption. We discuss the serious consequences, particularly the cash flow implications, which could result for employers and employees.

|

| |

|

|

|

|

|

|

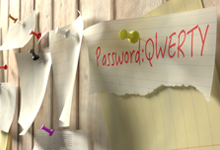

The Password Guru Got It All Wrong!

|

|

How many times have we entered a website and been asked to enter a new password which is at least 8 characters long and contains 1 capital letter, 1 number and 1 symbol like “@”? We end up with a password that is impossible to remember.

We look at how the password guru who recommended such configurations now says he got it all wrong, how easy it is to crack some such passwords, and what the guru now recommends instead.

|

| |

|

|

|

|

|

|

Your Tax Deadlines for September

|

|

Provisional and non-provisional taxpayers who do their 2017 Income Tax returns manually and post them or use a SARS branch drop box need to get their return to SARS on or by 22 September 2017.

The third provisional payment for the 2016/2017 tax year is due by 29 September 2017. This payment is voluntary and you only need to make it if you have underestimated your tax liability for 2016/2017 and you wish to avoid penalties and interest.

|

| |

|

|

|

|

|

|

|

|

Disclaimer

|

The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

|

|

© DotNews. All Rights Reserved.

|

A Client Connection Service by

DotNews |

|

|

|