|

|

|

|

|

|

|

|

Mid-Term Budget – Tax Highlights

|

The newly appointed Finance Minister, Tito Mboweni, delivered the 2018 mid-term budget statement on 24 October 2018 pledging to fix the South African Revenue Service (SARS) as a matter of urgency.

SARS will receive R1.4 billion more over the next three years to help with efficiencies.

More items to be zero-rated for VAT

Earlier this year, a panel of experts were commissioned to investigate mitigating the effect of the Value-added Tax (VAT) rate increase on low-income households.

The panel suggested that six items be considered for zero-rating, while pointing out that targeted expenditure would be more effective in helping low-income households.

In response, government proposes to zero-rate white bread flour, cake flour and sanitary pads from 1 April 2019.

ADMINISTRATIVE PENALTIES FOR CORPORATE INCOME TAX (CIT) TO BE IMPOSED

SARS will be imposing administrative penalties from December 2018 for outstanding Company tax returns. Previously, only outstanding personal income tax returns were subject to the imposition of penalties.

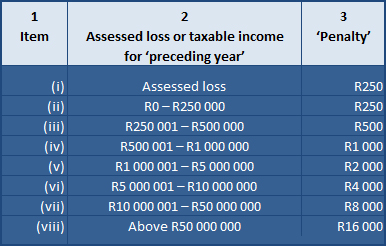

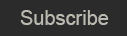

The penalties range from R250 to R16 000 per month that non-compliance continues, per outstanding return, depending on a company’s assessed loss or taxable income.

Table: Amount of Administrative Non-Compliance Penalty

|

|

|

To prevent the imposition of these non-compliance penalties any outstanding company tax returns need to be submitted before the end of November 2018.

Company income tax returns must be submitted within 12 months from the date on which its financial year ends. A dormant company is required to submit any outstanding returns prior to 2018 to prevent a penalty being imposed.

The criteria for the exception in 2018 are set out in Notice 600 of 15 June 2018, which is available on the SARS website.

|

|

|

|

|

|

|

|

When Hubris Grows, Can a Market Crash Be Far Behind?

|

|

It’s not easy to make informed investment decisions in this Age of Information Overload, nor will it ever be possible to accurately predict the next big boom or crash in the stock markets.

But economists suggest that there may be a few pointers to help us decide when the chances of an imminent crash are increasing.

We discuss two such potential pointers – interesting concepts that are well worth keeping an eye on. We’ll tell you how to do that yourself, and when you should think of taking professional advice on whether it might be time to start selling.

|

| |

|

|

|

|

|

|

Lack of a Medical Certificate Not Enough When Dismissing an Employee

|

|

As an employer what can you do about an employee who goes AWOL on sick leave one time too many? Is failure to produce a medical certificate grounds for dismissal?

We analyse a recent Labour Court decision in which an employee with a known medical condition, but also with a history of warnings for absenteeism, took four days off work just before Christmas. On his return he failed to submit a medical certificate as required by company policy.

The Court ordered reinstatement on the particular facts of the matter – a clear warning to employers that lack of a medical certificate is not in itself necessarily adequate grounds for dismissal.

|

| |

|

|

|

|

|

|

Cloud Based Accounting: Ideal For Your Small Business?

|

|

As a small business you want your accounting software to do the job quickly, securely and cost-effectively, making you as competitive as possible against big business.

We discuss how the technological revolution is reducing your costs, and we look at what “cloud accounting” is and how it works. It may or may not suit your particular business – you will need to take your accountant’s advice on that – but it has many potential benefits that you should seriously consider.

Read on for the details…

|

| |

|

|

|

|

|

|

Is Your Problem With SARS A Systemic Issue? If So, Speak To the Tax Ombud

|

|

Are you struggling in your dealings with SARS? If so, you aren’t alone, and the good news is that the Tax Ombud may be able to help.

We’ll start off with a look at what types of issues the Ombud can assist taxpayers with, and at the hoops you normally have to jump through before going that route.

There are however also circumstances in which you may be able to fast-track your way to the Ombud, the most significant of these involving “systemic issues”. What are they? And what can the Ombud do about them?

Read on for the answers…

|

| |

|

|

|

|

|

|

|

|

Disclaimer

|

The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact us for professional, detailed and appropriate advice.

|

|

© DotNews. All Rights Reserved.

|

A Client Connection Service by

DotNews |

|

|

|

|