Budget 2022: Your Share of Billions in Tax Relief and Business Support

“Now is not the time to increase taxes and put the recovery at risk! Accordingly, we have decided to keep money in the pockets of South Africans.” (Finance Minister Enoch Godongwana)

The 2022 Budget Speech brought some good news and welcome tax relief to personal and business taxpayers,

This is possible thanks to tax revenue collection estimates that exceed the 2021 Budget estimate by R182 billion. Given the improvement in revenue collections, government proposes R5.2 billion tax relief to help support the economic recovery, provide some respite from fuel tax increases and boost incentives for youth employment.

Tax changes for individuals

- Personal income tax brackets and rebates will be adjusted downwards by 4.5% to prevent taxpayers moving into higher brackets due to inflation, resulting in tax relief of an estimated R13.5 billion.

- The income tax threshold (under 65) has increased to R91,259 per year.

- Medical tax credits will increase from R332 to R347 per month for the first two members, and from R224 to R234 per month for additional members.

Tax changes for companies

Reduction in company income tax rate from 28% to 27% from 1 April 2022 (i.e. for tax years ending on or after 31 March 2023).

Support for small businesses

To support businesses in distress owing to the Covid-19 pandemic, a new business bounce-back scheme was announced; a new version of the R200 billion loan guarantee scheme that was part of the R500 billion stimulus package announced at the onset of the Covid-19 pandemic in 2020.

It will be implemented using two mechanisms which will be introduced in sequence:

- Small business loan guarantees of R15 billion will be launched next month provided through participating banks and development finance institutions, with Government underwriting the first 20% of loan losses.

- Treasury wants to introduce a business equity-linked loan guarantee support mechanism by April this year.

Some other issues to be aware of

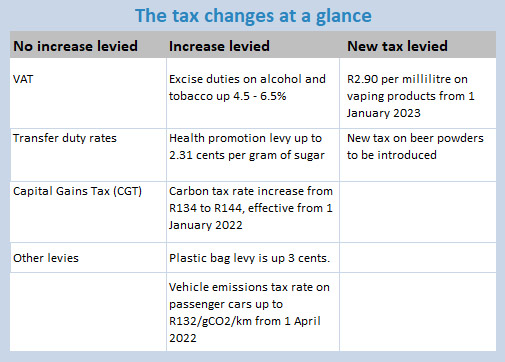

- The Minister cautioned that while VAT and other taxes have not been increased, this may change in the future, saying that if there are permanent expenditure increases in coming years, there would be no choice but to revisit this.

- Amendments are proposed to provisions relating to the taxation of variable remuneration to ensure wider application of these rules – particularly to the informal sector (‘Variable remuneration’ includes overtime pay, bonuses or commission; an allowance or advance paid for transport expenses; an amount the employee becomes entitled to as a result of unused leave; any night shift or standby allowance; or any amount paid or granted for a reimbursement as contemplated in the Act). In effect this income will only be taxed on receipt.

- Provisional tax: Government has proposed a review of the provisional tax system on the basis of international developments.

- Corporate tax reduction will be funded by limiting the interest deduction and assessed losses. Assessed losses brought forward will be limited to 80% of taxable income. Smaller companies with a taxable income below R1 million will be exempt.

- To address abuse of such incentives such as the Employment Tax Incentive, government proposes to impose understatement penalties on reimbursements that are improperly claimed in terms of this incentive.

- The Minister urged all companies that have not already done so to develop plans to progressively reduce their carbon emissions, to avoid facing steep taxes. Exporters will also face overseas border taxes for carbon-intensive goods such as iron and steel, which will reduce their competitiveness.

- SARS will be reviewing the processes surrounding the issue of tax clearances as well the declaration of the returns in order to curb tax compliance status abuse in which taxpayers may file an inaccurate return in order to obtain a tax clearance.

- To assist with the detection of non-compliance or fraud through the existence of unexplained wealth, all provisional taxpayers with assets above R50 million will be required to declare specified assets and liabilities at market values in their 2023 tax returns.

- Other future tax proposals include plans for a new personal income tax regime for remote work, a review of the exemption of foreign retirement benefits in domestic tax legislation, a review of depreciation and investment allowances.

- SARS says it focused on deliberate work audits of large business, which has generated an additional revenue in excess of R4 billion. It will focus on a number of revenue-generating priorities, which amongst others include the expansion of the use of data and intelligence; increasing capability to maximise debt collections; implementing the Davis Tax Committee recommendations for the corporate and High Wealth Individual compliance landscape; accelerate criminal investigations and counter illicit practices; and shaping the policy on the informal economy.

Provided by Huysamen Westraad Incorporated

© DotNews. All Rights Reserved.