Emergency Tax Relief: Is Your Business Eligible and What Should You Consider?

“SARS will implement these tax relief measures because compliant taxpayers have paid their fair share of tax, making it possible for government to provide such a temporary safety net in a time of extreme difficulty” (SARS)

Battered by national lockdowns of varying intensity since March last year, many businesses have been further affected by weeks of looting and riots in July. These cost 330 South Africans their lives, while our country lost about R50 billion in output, with an estimated 50,000 informal traders and 40,000 businesses affected, placing 150,000 jobs at risk.

For some businesses who had managed to survive in an economy that contracted by 7% last year, it was a final blow. In the economic hubs of Gauteng and KwaZulu-Natal, businesses, shops and warehouses were destroyed or shut down. Virtually all businesses across the country – and in neighbouring countries - were impacted by the resulting food, fuel and medical supply shortages, as well as disruption of supply chains when the ports of Durban and Richards Bay were brought to a standstill and the N3 highway was closed.

In response, on 25 July 2021, President Ramaphosa announced emergency tax measures to assist those affected by the riots and looting.

Three tax relief measures offered

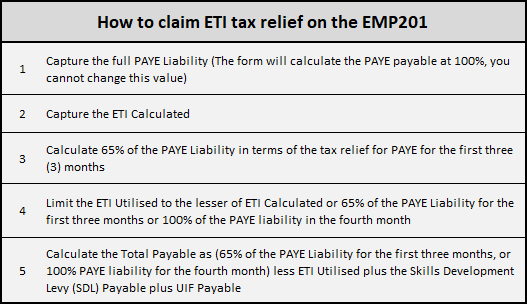

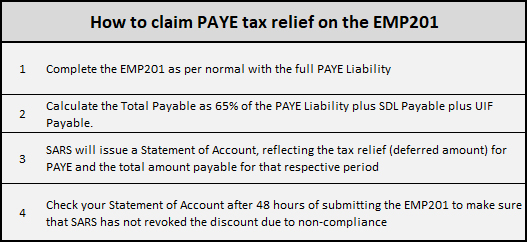

- A tax subsidy of up to R750 per month, for four months, per employee earning below R6,500 - 1 August 2021 to 30 November 2021 - under the current Employment Tax Incentive (ETI) for private sector employers. The first extended ETI can be claimed in your August EMP201 (due 7 September). SARS will pay monthly ETI refunds for the four-month period commencing on 13 September, subject to verification or audit steps required.

- Deferral of 35% of Pay–As-You-Earn (PAYE) liabilities over the three months - 1 August 2021 to 31 October 2021, without penalties or interest. The first deferment can be claimed on the August 2021 EMP201 return, due 7 September. After 7 November, SARS will determine the four equal payments for the total amount that you have deferred and include it in your monthly Statement of Account. Payments will be made over a four-month period that will commence on 7 December 2021 with the last payment due by 7 March 2022.

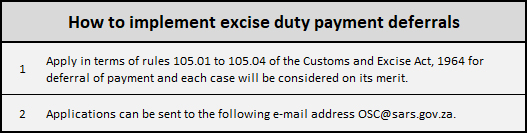

- Deferral of excise duty payments for up to three months for businesses in the alcohol sector.

Note that this deferral is available immediately.

What are the qualifying criteria?

- Only tax compliant companies qualify for the emergency tax measures and that means the business:

- Is registered for all required taxes.

- Has no outstanding returns for any taxes it is registered for.

- Has no outstanding debt for any taxes it is registered for, excluding instalment payment arrangements, compromise of tax debt, and payment of tax suspended pending objection or appeal.

- The employer must be registered with the South African Revenue Service (SARS) as an employer by 25 June 2021.

- The employee tax subsidy applies to tax compliant private sector employers with employees earning below R6,500 per month.

- PAYE deferrals apply to tax compliant businesses with a gross income of up to R100 million, with a limitation that gross income should not include more than 20% of income derived from specific listed sources.

- Excise duty payments deferrals apply to compliant licensees in the alcohol sector that have applied to SARS.

Issues to consider

- You are responsible – The law holds an employer personally liable for an amount of tax withheld and not paid to SARS, or which should have been withheld but was not withheld. The employer could also be held criminally liable for failure to withhold and pay PAYE.

- SARS’s focus on employers – Just weeks ago SARS announced it has teamed up with the NPA (National Prosecuting Authority of South Africa) to deal with tax non-compliance, initially focussing on non-compliant employers. SARS’ Criminal Investigations Division has already handed over 30 non-compliant employers to the NPA in their new joint venture.

- Mistakes are costly - While previously a mistake made by a taxpayer was only a crime when it was done “wilfully and without just cause”, taxpayers can now in certain cases be convicted of an imprisonable criminal offence even if non-compliance was due to negligence or ignorance. If you decide to implement the relief measures, call in professional assistance from your accountant to ensure accuracy and recordkeeping.

- We’ve been warned – Before announcing the details of these emergency tax relief measures, SARS Commissioner Edward Kieswetter made it clear that SARS has the capability to detect and make it costly for those that are non-compliant with their legal obligations and engage in criminal malfeasance. Get a professional opinion to ensure your company qualifies and that the relief is correctly claimed.

- Expect a verification or audit from SARS – ETI refunds will be subject to any verification or audit steps that may be required. Your accountant can assist you in preparing for the likelihood of verifications and audits, and in successfully completing a verification or audit when selected.

- Will you have recovered sufficiently in three months? Three months is a very short time in these unpredictable times. The ability to recover during the grace period is an important consideration: the company’s cash flow will improve initially, but after the three-month deferred payment period, an even higher PAYE liability is due – over the year-end and into the next financial year. Your accountant can help you to carefully project your financial position over the coming months to enable an informed decision.

- Can you afford the deferred tax repayments? While the lower PAYE payments for the three months of August, September and October will provide short-term cashflow relief, one quarter of the total deferred amount must be paid – on top of the company’s normal PAYE obligation for each month between November (due 7 December 2021) and February (due 7 March 2022). If your payment is made late, you will forfeit the benefit of the tax relief for PAYE and SARS will impose penalties and interest on the calculated total payable. It will also create other challenges, such as not being able to obtain a tax clearance certificate required for loan applications and tenders.

While these tax measures introduced for employers may be a lifeline for some companies to survive, all businesses are well advised to call on the advice and assistance of their accountant, both when carefully considering the decision to take up this tax relief and in claiming the tax relief.

Provided by Middel & Partners - Centurion

© DotNews. All Rights Reserved.