Property Buyers/Sellers and Budget 2017

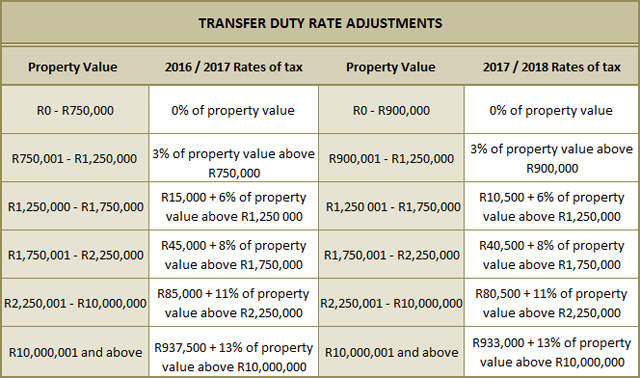

A sliver of good news in Budget 2017 was the 20% increase in the transfer duty threshold from R750,000 to R900,000. That should help both first-time and buy-to-let buyers, and hopefully it will help stimulate the property market overall. Even for buyers at the high-end of the market, the very fact that transfer duty wasn’t increased is in itself good news.

Have a look at the table below for details -

Source: National Treasury

Non-resident sellers

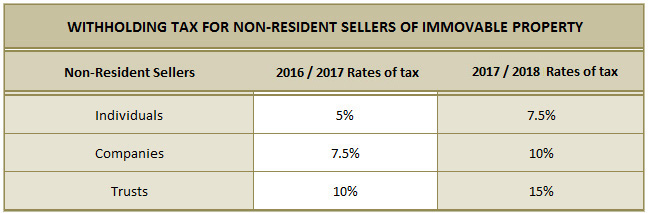

If you aren’t resident in South Africa and sell property for over R2m, the buyer has to keep back, and account to SARS for, “withholding tax” at a specified rate. In some circumstances you can apply for a tax directive to withhold tax at a lower or even zero rate - ask your conveyancer about this. And if your actual tax liability is in due course assessed at less than the amount withheld, you will be due a refund for the balance.

With the general tax increases applicable from 1 March, the amounts of withholding tax have increased as per the table below -

Provided by Kramer Villion Norris - KVN

© DotNews. All Rights Reserved.