Leasing: How Can It Help Your Cash Flow?

Small businesses (SMEs) often have cash flow difficulties. Leasing an asset as opposed to paying cash for it is one option to improve cash flow – a movable asset can be financed for several years.

The benefits of strong cash flow

We often speak about them but what are they?

- A strong cash flow takes the pressure off you as business owner – no longer is every decision solely cash flow focused

- It becomes easier for you to resist customer pressure. For example, you can more easily resist demands for greater discount or extra days for debtors to pay debt. As margins improve, so the organisation is placed on a sounder footing

- Your business can concentrate on longer term improvements such as branding and growing market share

Types of leasing – how to choose

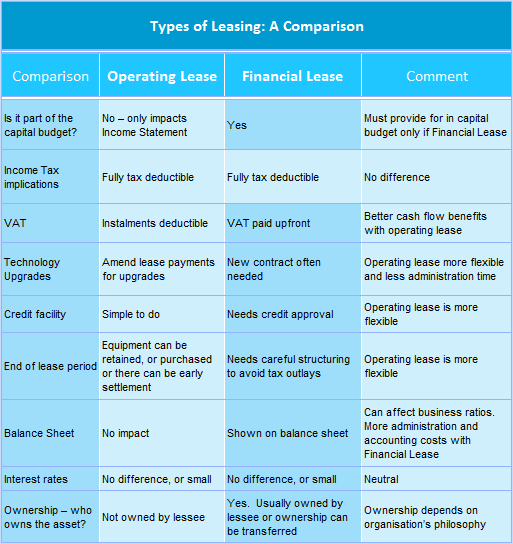

There are several leasing models out there but in essence, they boil down to two types:

- Operating leases

- Financial leases

The major differences can be summarised in this table:

(If the table above does not display correctly, please see the “online version” – link above the compliments slip)

There are some important issues here such as ownership of the asset (is it important to the business?), getting access to credit and the administrative impact on your organisation, cost (interest rate but be careful of the amount of other charges the financial institution may levy, such as administration costs) and the way your financials will look to the bank and any potential investors.

Both types offer cash flow benefits but differences such as tax treatment do give operating leases a cash flow edge. Ultimately it will depend on what kind of lease best suits your business.

Leasing and your customers

It is also possible to look at this process from the opposite angle - a business may, for example, produce a costly asset. In this case, your business may lose sales as smaller customers cannot afford the purchase price. They may, however, be able to pay a monthly lease, in which case a financial institution will be able to structure a lease to these smaller customers. Consider recommending this when making sales to smaller customers.

Leasing is a useful tool which can be used to enhance a business.

Provided by May and Company

© DotNews. All Rights Reserved.