|

|

| |

|

August 2022

|

Top Ten Tips for Maintaining a Strong Cash Flow

|

|

“Never take your eyes off the cash flow because it’s the lifeblood of business.” (Sir Richard Branson)

Managing cash flow is often one of the biggest challenges business owners face and is also the reason for a concerningly large percentage of business failures.

Cash flow can be defined as the total amount of money that comes in and then goes out of a business and – crucially - the timing between cash flowing in and cash flowing out.

A positive cash flow means the business earns more than it spends and is a key indicator of the financial health of your business. A consistent, positive cash flow ensures there is cash on hand to cover payroll, expenses and loan repayments on time and enables business growth by ensuring cash is available for timely equipment purchases and upgrades, and investment in new opportunities that arise.

As such, proper cash flow management is key to your short - and long-term financial success, and cash flow strategies should be a priority in your business planning. Good cash flow planning will allow you to predict when money can be expected to be received, and when it must be paid out. With this information, you can plan ahead and make smart business decisions.

Implementing the ten top tips below for maintaining a strong cash flow will ensure businesses can enjoy all these benefits in a short time and with little effort.

- Increase sales – More sales are obviously the preferred strategy for a business to grow the amount of cash flowing into the business, and it provides more benefits than other options such as liquidating assets or taking out a loan.

- Collect client payments quickly - Late payments from clients are one of the most common reasons why businesses experience cash flow problems. Manage this proactively by invoicing clients promptly and sending monthly statements early. Verify the invoice was received, and contact late payers well in advance, reminding them to pay on time. Follow up on late payments right away, offer discounts to clients who pay early, and implement a cash-on-delivery policy for chronic late-payers.

You could also consider requesting deposits when taking orders, and if you offer credit to clients, make sure to do credit checks first and maintain stringent credit policies.

- Adjust inventory - Inventory that doesn’t sell well will also negatively impact your cash flow. Move outdated inventory and offload less frequently purchased items for discounted prices and don’t replace this stock - rather invest more into stocking items that do sell well.

- Manage and trim expenses – Cash flow reduces as and when expenses are paid, so managing your expenses better and eliminating unnecessary costs will immediately boost cash flow. Also consider other ways to conserve cash flow, such as leasing instead of buying equipment.

- Prioritise payments - Know exactly which payments must be made when, then order according to priority, and spread payment dates so the most important bills are paid first and the less critical account payments with more flexible payment dates are paid later. Where necessary, negotiate payment terms with your suppliers.

- Increase efficiencies - Take advantage of technological advances and artificial intelligence-enabled solutions, such as apps, software and equipment to streamline your business processes and increase efficiency. Also, consider identifying operations or tasks that can be cost-effectively outsourced to freelancers and third-party service providers.

- Use a business credit card – A well-managed business credit card could be used to pay day-to-day expenses during the month to free up cash. This will require keeping a tight record of those expenses and being disciplined in repaying the full balance within the interest-free period. It will also allow the business to benefit from any rewards programs that can reduce expenses, such as a certain percentage of cash back on some purchases.

- Keep a line of credit – A business line of credit can be a saving grace for small businesses and companies impacted by seasonality. It provides quick access to funds when needed, for example, to bridge gaps between invoicing and payment, to buy equipment, to cover seasonal or unexpected expenses, or to take advantage of growth opportunities. The business will have to negotiate such a facility before cash flow problems arise.

- Make your money work - At times, there may be a surplus of cash, for example, in seasonal businesses, and at these times, it is crucial to make sure this money works for the business. This can be achieved through building up a reserve fund for emergencies, which experts suggest should ideally be sufficient to cover six months of business expenses; making smart short-term investments and paying off debts faster to reduce interest and shorten loan terms. Consider investing any surplus cash, short-term or otherwise, in a money-market call account to earn interest rather than leaving it idly resting in the bank account.

- Use accounting expertise - Successfully monitoring and projecting cash flow often requires professional assistance. Alongside the balance sheet and income statement, the crucial cash flow statement is one of the three main types of financial statements. Generally covering three main areas: everyday business operations, investment activities, and financing, it reveals trends and allows potential cash flow problems to be identified and managed in time.

Projecting future cash flow requires assessing the previous year’s numbers as the basis of cash flow for the following year and then adjusting these numbers for anticipated changes, such as new pricing, more staff and new funding sources. Of course, these forecasts will change continuously, so it’s important to monitor cash flow on an ongoing basis.

Speak to your accountant about accessing cash flow reports regularly and for professional assistance in understanding what they reveal about your business, to enable more accurate and relevant business decisions.

|

|

The Importance of a Good Credit Score

|

|

“You cannot escape the responsibility of tomorrow by evading it today.” (Abraham Lincoln)

A good business credit score is a critical tool in business success as it helps your business unlock, establish and maintain relationships with lenders, suppliers and vendors. It reveals whether an organisation should lend your business money, give it credit or enter into a business relationship.

Building good business credit is, therefore, a vital aspect of running any enterprise and the sooner you embark upon developing a good credit reputation, the better. Business credit allows access to the funding you may need to expand, or get through a tough time, and can even give you better terms with suppliers and other vendors. Perhaps most importantly though, by establishing a good business credit score, you can take an important first step toward creating a dividing line between your business and personal finances, even if you’re running a sole proprietorship or partnership.

So just how do you build this credit score and just what do you need to do to ensure you have the best score possible when the time comes to use it?

So, what is business credit?

Your business’s credit is a score that measures your history of borrowing and making repayments. In South Africa, TransUnion and XDS compile commercial credit reports and generate business credit scores using the information given to them by financial institutions such as your bank as well as any defaults that may have been recorded against you by those who may have loaned your business money or advanced it credit facilities which the business has failed to repay on time or at all.

Putting together this information will give any potential vendors and loan companies a clear picture as to just how reliable your business is when it comes time to pay back any loans or accounts.

In South Africa, scores can range from 0 to 100 for some bureaus and 300 to 850 for others. The higher the score on the scale the safer it is to loan money to the business. For instance, any score lower than 527 on the latter scale is considered high risk, while scores above 750 are considered low risk.

Any business that records a high-risk level will therefore find it difficult to secure loans or indeed potentially even rent office space.

There are four different criteria that the bureaus look at to calculate your score.

- Your debt payment history,

- Amount of credit used or your credit utilisation ratio,

- Your length of credit history, and

- Your credit mix which looks at how you use credit and what kinds of credit are available to you.

As these reports are generated based on past behaviours, new companies may find it extremely difficult to secure loans. Without the history of past behaviour for a potential loan company to examine, your business’s risk would likely be considered fairly high.

How do you build your credit score?

So just how do you go about building your credit score? And how do you avoid falling foul of the system?

- Pay your creditors on time: This one really goes without saying. If you contract for a service or supply, you must pay the bill for that service timeously and on the agreed upon terms and date. Failing to do so could allow that creditor to list you with the bureaus thereby damaging your credit score.

- Use less revolving credit: Revolving credit is the kind of credit that is always available to you to use as long as you keep on making the necessary payments on the outstanding balance. Credit Cards, where a set amount of credit is extended and which can be drawn against and used as needed is an example of this type of credit. This differs from instalment credit where there is an end goal amount to be paid off and that amount may not necessarily be advanced again once a payment is received.

Revolving credit can be a good way to establish a relationship with financial institutions and help you build a credit score, but it can also be a trap. Revolving credit impacts a portion of your credit score called Credit Utilization which looks at just how much of your available credit you are using at any given time. Your Credit Utilisation is a calculation of how much of your overall credit you're using and the amount of credit available to you at any given time. This calculation shows lenders and the credit bureaus how reliant you are on credit. Keeping it low on all your store and credit cards will positively impact your score. It will show lenders that you know how to use credit and you aren't racking up debt that you cannot afford to pay. As a guide, you should try not to use more than 25% of your available revolving credit at any given time.

- Fix your cash-flow errors: Missed payments don't always happen because your company is doing badly. Quite often they can be missed because a large invoice has simply not been paid on time. Making sure you have a balance of reserve money is important to ensure you don't miss any crucial payments as credit scores do not have an excuses column to factor in as to why you missed your repayment obligations.

- Avoid missed payments and judgments: This takes us on to the next step, which is missed payments and their severe cousin, judgments. Missing too many payments is already bad, but worse is when a company gives up on you and files a warning with the bureaus that you are not to be trusted. Typically, defaults are listed for credit accounts overdue by 90 days or more.

“Defaults” such as subjective classifications of consumer behaviour (delinquent, default, slow paying, absconded, not contactable and the like) typically remain on a credit record for one year, whilst classifications related to enforcement action (handed over, legal action, debt write-off etc) remain for two years.

If a court judgment is issued, that stays on your credit record for five years and remains collectable for thirty years in total.

- Keep your suppliers in the loop: To avoid missed payments and judgments it's highly advisable that you keep suppliers and creditors in the loop should you miss a payment or expect to miss one in the future. Explain what you have done to rectify the matter and when they can expect payment to avoid having your mistake recorded on your credit score. Of course, it is essential to then ensure the payment is made as promised.

- Establish business credit with companies that report trades: Establishing a good credit reputation with companies such as banks that report to the bureaus is a good way to ensure you build a credit score quickly. Using credit responsibly helps establish your ability to show discipline and pay on time and in full. Other companies that may report on your behaviour include telecommunications and utilities companies.

Get your free reports

The National Credit Act states that every business is entitled to access their credit reports once a year, totally free of charge from each credit bureau. Keeping track of your credit score will allow you to see whether your business is improving or falling behind on its goals and give you a clear picture of just how others perceive you. It will also allow you to see if the information there is correct – incorrect judgments can be included on these bureaus, and checking the reports helps you correct any that may be hurting your company's credit score.

Head to these links to get your credit score report directly from each bureau:

In conclusion, a credit score is about your relationships with those with whom you transact. If you make payments timeously, use the credit that is available to you, and keep an eye on your credit score for any inaccuracies, you should be able to build a solid credit score in about two years.

|

|

Choosing Accounting Software for Your Small Business

|

|

“Creativity is great - but not in accounting.” (Charles Scott, Former governor of Kentucky)

Being able to track money as it is coming in and going out is essential for small business owners. Not having proper cash flow management and a full understanding of where your money is going makes it hard to analyse where your business can improve and whether it is succeeding. Come tax season compiling your tax returns accurately becomes extremely difficult if you haven't been keeping track of every receipt and invoice.

Fortunately, small business owners can now use out-of-the-box software that is capable of helping them to track these important aspects and ultimately to compile their various tax returns. This software can also help when it comes to invoicing clients, reconciling transactions and generating the reports. But how do you know which software programs are right for your business and which are simply more powerful than you need? And how do you balance the features you want with the budget you have?

Ask yourself these six questions –

- Is it simple to use?

Perhaps this goes without saying, but any software you choose needs to be simple to use. As a new business owner you are likely not an accountant and perhaps you lack basic IT skills (which is not unusual). The more complex the system the more time it will therefore take for you to get used to it, and further, to actually complete the day’s necessary tasks. When you are already overloaded with work, the addition of an extra thirty minutes of bookkeeping a day can really add up and put strain on your other deadlines.

While reviews can be helpful to narrow down your selection, it is advisable that you try out a few accounting systems before you settle on the one you want to use. Most accounting software is offered on either a free trial or comes with a guided demo to explore the interface that is easily visible before any purchase. If the software you are looking at has neither, it is wise to stay clear.

If there is more than one person who will be using the system involve everyone in the decision-making process. Draw up a list of essential, common uses and take the opportunity of the trial to run through generating monthly reports, sending invoices, and running payroll. Simply by testing the software you will quickly discover which is the better fit for you and your team.

It’s very important that the software is easy enough to use straight from the get-go. Don’t make excuses for the program by blaming yourself or promising it will be easier to use once you have “played around a bit.”

- How good is the technical support?

In this light, it's also extremely important that whatever software you do go with has helpful and responsive support. If you do ever run into a problem, it can cost a fortune to get an independent expert to help out, so rather go with a program that comes with the support you need from the beginning.

Generally, the best way for you to gauge whether their technical support is good is by looking at the reviews. Make sure you read these carefully and look for any issues around a lack of responsiveness from their side. Believe us, if there are problems, they will all be spelt out in the review. The worst time to find out that a company you are about to work with is not helpful is just after the system has collapsed and invoices are waiting to be sent out.

- What features do you need?

Before you commit to buying any software it is extremely important that you work out just which features you need, which you don't and which may be nice to have. What do you need the accounting software to do? Must it be able to track accounts receivable and payable? What kind of reports do you need to generate? Do you need it to track inventory? Do you need it to include ancillary services, such as time tracking, project management and payroll? Determining these aspects is important as every feature you add will likely also add to the cost and you don't want to be paying for features you really don't need.

There are other features to consider too that have little to do with the actual accounting functionality of the system. There are:

- Integration: How easily does this software integrate with your other systems. It's no good buying an accounting program that only runs on Apple when you are a Windows Office user. Beyond the obvious you should ask, “Does this software integrate with your shipping system, and sales platform?” Choosing software that integrates across the board could save hundreds of hours of troubleshooting in the future.

- User access: Just how many people can be authorised to use this piece of accounting software? Can you set different levels of visibility and authority for different people? Perhaps you want your sales team to be able to invoice clients, but not see all the same things your accountant can see? Is this possible? Make sure the system you buy has the user access capabilities you need.

- Accessibility: How accessible is your data? Most accounting solutions these days offer cloud-based access, allowing you to check your accounts from anywhere in the world and on any device. Which services are available on the app and which are available on the core program? Which services are essential for you to be able to operate remotely?

- What is your budget?

Every cent can make a difference to the small business and your accounting software is no different. When making your choice, it’s important to formulate a budget and stick to it. Apart from your starting costs watch out for any additional charges, which may add up. When purchasing make sure you fully understand things like setup and customisation fees, to make sure you’re not missing anything.

- Will you need to upgrade down the line?

When choosing an accounting system, you need to be aware, not only of your needs now, but also of your potential needs in the future. You may only need essential recording and reporting at this stage, but in the future might foresee the need to scale the system to do payroll and other valuable tasks. Carefully balance your current budget and your needs with your potential growth - how long will it take before you need to upgrade? What features will you need when you do? You may decide that you need to choose a system now that can be easily scaled at a later date, requiring you to spend a bit more money. Alternatively, it may make sense to use a simple system now with no scalable benefits and then overhaul it to a more complete system later. All of this is going to depend, not only on budget but on how much appetite you have for training and learning new systems in the future.

- What do your accountants suggest?

Discuss your financial recording and reporting needs with your accountants. It is likely they have assisted and advised other clients on the selection and set-up of systems appropriate to various businesses’ needs. They may well have ‘war stories’ to tell of issues and systems you need to be wary of.

|

|

Is Your Trust Registered and Ready for Income Tax?

|

|

“A trust is a ‘person’ for tax purposes and is therefore a taxpayer in its own right.” (SARS)

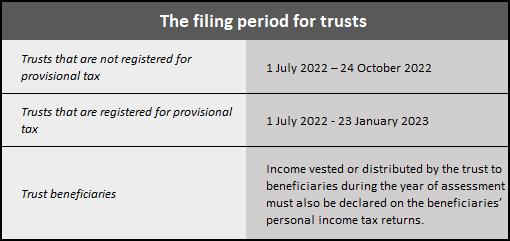

SARS recently sent out a reminder confirming that in terms of the Income Tax Act, 1962 (ITA), all trusts are taxpayers and that the trustees, who are also the representative taxpayers of the trust, have a responsibility to register the trusts - whether active or dormant - for income tax purposes.

The representative taxpayer (trustee/s), or the appointed tax practitioner, must also file an income tax return for the trust on an annual basis, and before the tax season deadlines to avoid penalties and interest.

Trusts that are required to register include all local trusts, non-resident trusts that are effectively managed in South Africa, as well as non-resident trusts that derive income from a South African source.

Why business owners use trusts

Trusts are used to hold, protect and ensure the continuity of ownership of personal or business assets, shares in businesses, and the right of use of assets.

The benefits include protection of assets against creditors, for example in the case of liquidation or sequestration, and against other parties - for example an ex-spouse, or ill-intentioned family member.

Where appropriate, a trust can be a useful tool to help ensure effective future planning; achieve continuity through efficient succession; and even managing certain tax liabilities, such as estate duty.

A business can also be registered in a business trust, also called a “trading trust,” instead of registering as a company with the CIPC. This option, however, is only appropriate where the main aim is conducting business, and a contractual agreement will task the trustees to manage the assets of the trust for a profit.

While a business trust can be useful to protect assets and safeguard the business owner against certain liabilities, it also has several drawbacks and may not always be the right alternative to registering a company.

Whether a business or personal trust, professional advice and guidance is crucial, because not only are the rules governing trusts complex, but the taxation of trusts requires specialised expertise.

The taxation of trusts

Whereas companies in South Africa are taxed at a flat rate of 27% for years of assessment ending after 31 March 2023, the income tax rate for trusts is currently 45%, and it is levied on any income retained in the trust.

This is the highest income tax rate, and trusts also do not qualify for any of the rebates provided for in Section 6 of the Income Tax Act.

Trustees may allocate income and capital to multiple beneficiaries, so that the tax obligation is spread, possibly at a lower rate in some instances. This is because, depending on circumstances, income distributed may be taxable in the hands of the founder, the beneficiaries or the trustees.

There are also special trusts, taxed at a sliding scale of 18% - 45% (the same as natural persons), and some special trusts also qualify for certain relief from Capital Gains Tax.

How to submit a tax return for your trust

It sounds quite simple in theory: an ITR12T must be completed and submitted.

In reality, a ITR12T trust tax return is a 31-page document, and completing it correctly is no quick or easy task.

Firstly, a trust must be registered with SARS for the taxes for which it may be liable. In addition, the trustees of the trust – who are also the representative taxpayers of the trust – must file the return within the tax season deadline. This responsibility may be conferred to a specific trustee, or to a professional appointed by the trustee(s).

To make it easier to comply, SARS has announced some enhancements to its system. For example, whereas one could previously only register a trust via a visit to a SARS branch, taxpayers can now register a trust for tax purposes through the SARS Online Query System and also submit any supporting documents online.

Furthermore, the ITR12T trust return form is now available on eFiling. The representative of a registered trust can request the return on eFiling and customise it by completing the questions on the Tax Wizard. Requesting the ITR12T to be posted, as was previously required, is no longer an option and trust returns received via post will be rejected.

Taxpayers registered for eFiling are also able to complete and submit the return online. Only trusts with ten or fewer beneficiaries have the option to have the ITR12T return captured by a SARS agent at a branch, and only if an appointment has been made.

When the filing period for trusts ends, SARS will raise original estimated assessments on ITR12Ts that were not officially filed by the taxpayer.

After the estimated assessment has been raised by SARS, the taxpayer will be allowed to request an original (new) return to be submitted to SARS. The same estimated return will be issued on eFiling to be completed, with a new version number of the return.

The taxpayer will be able to request a correction after the original return has been submitted, until one or two rejection letters have been received from SARS. Thereafter, the taxpayer will have the option to dispute the decision taken by SARS.

Bear in mind…

- SARS introduced a number of form and system changes in respect of trusts from 24 June 2022.

-

SARS has advised trusts that all outstanding income tax returns are submitted without delay to avoid further penalties and interest.

- SARS reminds trusts not registered for income tax purposes of the availability of the Voluntary Disclosure Programme (VDP), an option that should only be considered after obtaining professional advice.

- If the ITR12T return is not submitted by the relevant deadline, the trust will be liable for an administrative penalty due to non-compliance.

- Provisional taxpayers are required to make provisional tax payments within six months after the commencement of a year of assessment and then again by the end of the year of assessment.

- The trust is required to keep all the relevant material and supporting documents for a period of five (5) years from the date of submission of the return. SARS may, within the 5-year period, request these documents to verify the information that was declared on the ITR12T.

|

|

Your Tax Deadlines for August 2022

|

- 5 August – Monthly Pay-As-You-Earn (PAYE) submissions and payments

- 25 August - Value-Added Tax (VAT) manual submissions and payments

- 30 August - Excise Duty payments

- 31 August - Value-Added Tax (VAT) electronic submissions and payments & CIT Provisional payments where applicable.

|

|

Note: Copyright in this publication and its contents vests in DotNews - see copyright notice below.

|

| |

|

|

|

|