|

|

| |

|

SEPTEMBER 2014

|

The Revised Employment Equity Act: Where Does It Leave You?

|

Changes to the Employment Equity Act (“EEA”) became effective on 1 August. They will force businesses to focus more on transformation in their businesses and to carefully review their human resource policies.

The main changes

- Discrimination: Employers (all employers are subject to the unfair discrimination provisions of the EEA) may not discriminate, either directly or indirectly, against an employee on “the grounds of race, gender, sex, pregnancy, marital status, family responsibility, ethnic or social origin, colour, sexual orientation, age, disability, religion, HIV status, conscience, belief, political opinion, culture, language, birth or any other arbitrary ground”.

A difference in pay or conditions of work between “employees of the same employer performing the same or substantially the same work or work of equal value” is now also specifically declared by the revised EEA to be unfair discrimination, if it is based on any of the above criteria.

Should an employee take you to court alleging discrimination on the above grounds (excluding arbitrary grounds) the onus is on the employer to prove no such discrimination has taken place.

- Greater powers have been given to the authorities to get employers to comply with the EEA. Apart from increased enforcement mechanisms, fines for non-compliance have been tripled and linked to business turnover. These could be as much as R2,7m or 10% of turnover (whichever is greater) for serial offenders which effectively could cripple a small or medium sized business.

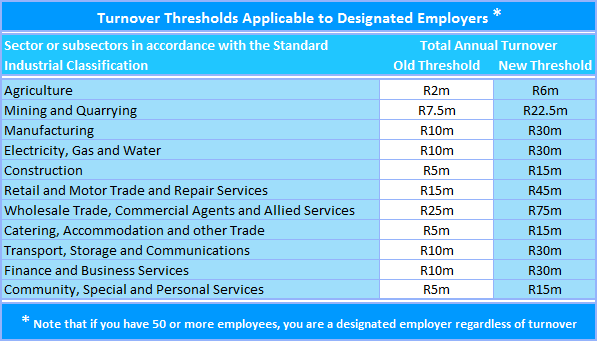

- The threshold turnovers to be a designated employer (only “designated” employers are subject to the affirmative action provisions of the EEA) have been tripled which is positive. However it depends on which industry you belong to - for example, the construction industry threshold is R15 million in turnover which is low for that industry (see the table below for all the new thresholds). Note that if you have 50 or more employees, you are a designated employer regardless of turnover.

- Designated employers with less than 150 staff reported every second year but will now be required to submit an annual report.

- Employees falling within the protections of the Basic Conditions of Employment Act – below gross annual salary of R205,433-30, may go to the CCMA for discrimination complaints against their employer. This makes it easier for employees and more cost effective to have such complaints heard. As an aside, it is also worth noting that any case of sexual harassment will be heard by the CCMA.

- Any psychometric testing of employees must be approved by the Health Professions Council of South Africa.

Note also that the controversial demographic regulations that targets for staff be representative at a national level, as opposed to a regional level, have been withdrawn.

The new turnover thresholds

(If the table above does not display correctly, please see the “online version” – link above the compliments slip)

(If the table above does not display correctly, please see the “online version” – link above the compliments slip)

One important implication

Apart from the increased policing and punitive powers introduced into the EEA, employers need to carefully re-examine their human resource policies in terms of the new discrimination clause (see above). If an employee takes you to the CCMA for discriminatory policies, the burden of proof lies with you. The way to establish this proof is through clear policies (remember the wording includes “indirect” discrimination which means you will need to be very careful in your policies) which will stand up to scrutiny.

You will thus need to consider why you pay more for experience, responsibilities of the job, skill and qualifications. Depending on your business you may need to consider job grading and other personnel policies. This will clearly be a burden for SMEs who do not have formal guidelines or policies.

The amendments to the EEA are now law and need to be carefully analysed and considered.

|

|

The Companies Act And Conflicts Of Interest: The Risks Of Non-Compliance

|

|

There is no doubt the drafters of the new Companies Act (“the Act”) considered conflicts of interest as crucial to governance. It is an unalterable section of the Act and thus overrides the Memorandum of Incorporation if it allows conflicts of interest.

The Act is specific in terms of its requirements and the price for not adhering to the Act can be high.

How does it work?

If a director or a related person has a personal financial interest (defined as a material interest to which a monetary value can be attached) in an entity and the business considers doing business with this entity, the director must disclose this to the board, answer any questions put to him and then be recused from the meeting. The director cannot vote on this matter or execute any documents in relation to this matter (unless requested to by the board).

Similarly, should a director or related person acquire a personal financial interest in a business that the company has a material interest in, this matter is to be “promptly” disclosed to the board.

Who does it apply to?

All directors, alternate directors, members of board committees and "prescribed officers" (managers who have control of the business or a significant slice of the business).

Included in this net are people related to any of the above. Spouses, life partners and people related to a second degree of consanguinity are related persons. Juristic persons (e.g. companies) are related persons to the extent they are directly or indirectly controlled by a person. This is something to be particularly careful of when involved in a group of companies.

A director is required to inform him or herself as to what interests a related person has. Ignorance is not acceptable.

The risks of non-compliance

Any contract entered into where there is an undisclosed interest is void. Only a subsequent resolution of shareholders or a court can ratify this.

A director who does not declare an interest can be held personally liable by affected parties and can face criminal charges.

Although the Act does not prescribe how to manage conflicts of interest, companies should have a register of interests and have this signed at every board meeting to keep this important subject top of mind.

|

|

The New Tax Dispute Resolution Rules: Better Rights For Taxpayers

|

|

Taxpayers have often felt helpless in disputes with SARS when they have been left waiting for responses to queries or objections. Going to court is not an option for most taxpayers but new rules recently gazetted relating to disputes between taxpayers and SARS will give taxpayers hope.

These new rules cover issues such as objections, appeals, the Tax Court and alternative dispute resolution.

One interesting aspect covered is that SARS have finally accepted electronic communication as a means of submitting documents, objections and notices to SARS. Taxpayers will need to monitor their eFiling profile as SARS can post items on it without notifying the taxpayer. Note here that if you use eFiling to submit your return, you are required to use form N001 for an objection.

Be careful!

If you want to dispute anything with SARS, it is critical that you follow the steps and time frames laid down by tax law. Should you fail to comply, SARS will end the dispute, leaving you liable to pay taxes they have raised.

The time frames and the process

The new rules allow either party to apply to Tax Court for summary judgment. One of the parties has to be in default in terms of the time frames laid down or in relation to a commitment to provide the other party with documentation.

To start the process, the “wronged” party gives notice that they intend applying to the Tax Court for summary judgment – this means if, say, SARS has not given a decision on an objection in the required time period, then the Tax Court can set this aside and SARS can proceed no further with the matter.

The other party has fifteen business days to remedy the default, failing which the matter goes to the Tax Court. Should the other party oppose this, it has ten business days to submit an affidavit to the Tax Court.

The Tax Court will convene a hearing and may either issue a summary judgment or give the other party more time to redress the default, failing which the process will be set aside.

Thus, the taxpayer now has a concrete way of reaching finality in a dispute with SARS.

|

|

Finance 101: The Importance Of Savings

|

|

“The rich rule over the poor and the borrower is servant to the lender” Proverbs 22:7

In South Africa we do not have a culture of savings and we have one of the lowest savings rates in the world. This has been steadily declining since the late 1970s. In 1979 our savings rate was 33% of Gross Domestic Product (GDP) and now it is less than 14%. At a household level our savings as a percentage of disposable income are negative whereas in China for example they are more than 30%.

This is particularly bad for South Africa because as a developing country we need to build up our infrastructure; but our poor savings mentality makes this more and more difficult to achieve.

What does this mean for us?

At a macroeconomic level this means that in order to finance capital projects, South Africa needs to borrow funds from abroad. As this level of borrowings rises we become more dependent on foreign capital and so our risk profile increases which pushes up the cost of these borrowings. This in turn contributes to the declining value of the Rand. Effectively, the national balance sheet becomes progressively weaker.

At a household level, the effects are similar. As we increase our level of borrowings, so our cost of borrowing increases until we become too high a credit risk. Many households then borrow from micro lenders (at prohibitive costs). Our household savings to disposable income was 6% in the mid-1990s and is now -1%.

Having savings cushions people against shocks such as losing one’s job.

What can you do to fix it?

Clearly, we need to get more people to save. Much can be done at the macro level such as increasing the employment rate. But what can we do as individuals?

A starting point is education – the importance of saving and becoming financially independent needs to be disseminated to those who do not save. Whilst there is poverty in South Africa, there is also plenty of wasteful expenditure such as gambling and buying unnecessarily extravagant products. Think tanks propose that we advocate that people develop a savings mentality, have a household budget and stick to it.

So it is important to educate and encourage your staff and people around you to save. It will have substantial benefits for the economy and for South African households.

SOME GOOD NEWS SNIPPETS

To end on a positive note -

- 34% of South Africans give their time to charity or a campaigning entity. This is more than any other country – the UK for example gives 22% of its time.

- The infant mortality rate in South Africa has dropped by 50% since 1990.

|

|

Your Tax Deadlines For September

|

|

And remember that manual Income Tax returns must be submitted no later than Friday 26 September.

|

|

Note: Copyright in this publication and its contents vests in DotNews - see copyright notice below.

|

| |

|

|

|

|