|

|

| |

|

July 2018

|

Your 2018 Tax Season Deadline: Brought Forward By Three Weeks?

|

“The best way to teach your kids about taxes is by eating 30 percent of their ice cream” (Bill Murray)

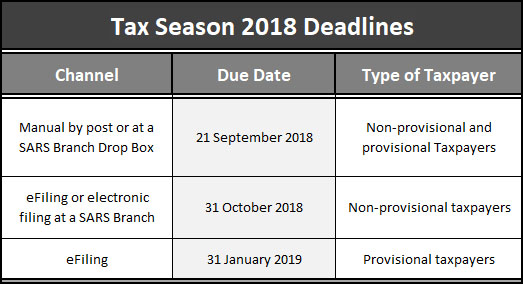

The 2018 tax season for individuals opened on 1 July. Non-provisional taxpayers who use eFiling or file electronically at a SARS branch have had their submission deadline cut to 31 October. Other classes of taxpayers (provisional and those who manually submit their forms) are on similar deadlines to prior years.

This change stems from SARS streamlining the process this year. This has benefits for both taxpayers and SARS.

How and why SARS is streamlining the process

- Nearly two thirds of non-provisional taxpayers’ returns are completed within three months i.e. they are in by end September. This is followed by a lull until the middle of November when there is a last minute rush to complete these returns.

SARS has brought the deadline for these taxpayers forward by three weeks. Thus taxpayers who either use eFiling or submit electronically at a SARS Branch must send in their returns by close of business on 31 October.

This is significant as it affects the bulk of taxpayers. Make sure your staff members are aware of this date as there will be penalties and interest on late returns.

The reason for this change is twofold:

- It smoothes the workflow of SARS. The lull period they previously experienced will be taken up assessing returns in October. SARS will be able to request verification and finalise assessments by the Christmas break.

- The bulk of taxpayers in this category will now have their returns finalised in December. This will give these individuals more peace of mind as they are less likely to have to answer queries during the holiday break.

- 1.6 million taxpayers submitted tax returns last year when they did not need to do so. This adds unnecessary workload to these taxpayers and to SARS who are overwhelmed by the volume of work during filing season.

SARS has communicated with those 2017 taxpayers who unnecessarily submitted returns, urging them to only submit a return if they fall within SARS’ requirements. If this is successful, 25% less tax returns will be submitted.

Taxpayers do not have to submit a tax return if:

- Their employment income is R350,000 or less for the year and

- They have one employer during the tax year and

- They have no other income such as rentals received, car allowance and

- They do not claim additional deductions e.g. medical costs, retirement funding.

- Approximately 860,000 eFiling registered taxpayers came into a SARS branch to do their tax returns in 2017.

These taxpayers will be assisted by the Help-you-eFile service which will connect a member of SARS directly to the taxpayer. The taxpayer will then be helped through the eFiling process. SARS hope this will significantly increase the number of eFiling returns.

- 120,000 tax practitioners used a SARS branch to complete their clients’ returns.

All tax practitioners will be encouraged to use eFiling for their clients’ submissions.

- Both taxpayers and SARS staff get inundated with documentation during filing season.

When requesting verification data, SARS will be specific about the documentation it requires. This will reduce paper flow and time spent on this process by both the taxpayer and SARS.

- 2018 returns will be prioritised and taxpayers submitting income tax forms from prior years will have to wait longer for assessments. SARS has found that many of the scams surrounding tax happen with past-due tax returns. This will give SARS more time to check and detect fraud.

- Lastly, SARS will net off refunds or amounts owed on past returns, giving taxpayers a better picture of what is due to them or what they owe.

Your 2018 Tax Season Deadlines

|

(Adapted from a SARS table)

Overall, the situation should improve for both taxpayers and SARS.

|

|

|

Will Cash Disappear From Society?

|

“Forewarned is forearmed” (Wise old proverb)

In the last decade we have witnessed the slow death of the cheque. Today we have Bitcoin, payment apps and increasing use of the Internet and credit cards, so the question arises is cash also going to disappear? If so, it will have enormous implications for us.

The case for cash disappearing

In a recent study, 78% of Europeans expect to use less cash in the future. Countries such as Sweden and South Korea are pioneering the way to a cashless society and argue that:

- Cash is incredibly expensive and costs between 5 and 15% of revenue. This is when you factor in the cost of ATMs, cashiers, the cost of bank branches (in Sweden only 5% of branches handle cash), security transit vans, the time taken to deposit cash and high bank charges.

The Bank of America says that 10% of its cost base is due to managing cash.

- Robbery and crime fall when there is less money about.

- It reduces organised crime and terrorism. In Europe the 500 Euro note is being phased out after it was discovered that the terrorists who killed 89 people in Paris in 2015 used high denomination notes to fund the attack.

- Tax revenues, particularly indirect revenues like VAT show marked increases. VAT collections have improved 30% over the last five years in Sweden.

The other side

Contrary to conventional wisdom, cash now accounts for 9.6% of global GDP, up from 8.1% in 2011. The number of people in the UK who rely on cash has risen from 500,000 to 2. 7 million and in the past decade in the U.S.A., money in the economy has grown 50% relative to GDP.

So why is money still so prevalent?

There are some easy explanations such as:

- The low interest rate environment has encouraged people to keep money rather than put it in the bank.

- Globally the informal economy is growing and cash is the medium of exchange in this sector.

- The global financial meltdown of 2008/2009 resulted in more people losing faith in banks.

- The use of credit cards and other electronic payments has seen the level of consumer indebtedness grow. In fact, there is a very close correlation in countries embracing cashless societies and the growth in consumer debt. In a recent study, McDonalds put electronic devices in stores where consumers could order and pay online. Their sales in these stores rose by 30%.

- The number of Internet scams has pushed people towards hoarding cash.

- Crime statistics have in fact not gone down as was claimed above. In fact, where criminals can’t rob people of cash they go after the more vulnerable citizens such as the elderly.

In addition there are more subtle explanations such as:

- In the current world of cynicism and mistrust, banks are regarded as part of the system supporting the wealthy top 1% which encourages people to move away from banks.

- The recent incidents of state hacking (e.g. Russia meddling in the US 2016 elections) have given those in favour of a cashless economy doubts. Potentially, hacking could cause the financial infrastructure to collapse in which case it is prudent to still have cash in the economy.

The debate swirls on and on but it is probably safe to say that cash will be around for a long time, particularly in a developing country like South Africa.

|

|

Have You Been Hacked? Check Now!

|

In May this year data the ViewFines website was hacked, exposing a database containing the passwords, cell phone numbers, email addresses and I.D.s of 934,000 South African drivers with traffic fines. “If you think you may be at risk from the ViewFines data leak, read this article for more detail

Last year the databases of several large estate agencies were hacked into and over 60 million records of personal information including IDs were exposed. New hacks are reported with depressing regularity, so this is clearly a growing phenomenon - not just in South Africa but globally.

Have I been hacked?

Troy Hunter is a globally acknowledged cyber security guru who picked up this breach. His website will tell you if you have been hacked – during this or any of the many other global hacks over the years - and if so when. Check it out on the “Have I Been Pwned?” website.

Enter all of your email addresses and you may be unpleasantly surprised by the results.

What should I do?

Check all your passwords. If your password for ViewFines.co.za (or any other hacked website) has been used for other accounts, then you are at risk.

Troy Hunter also offers an excellent service in terms of password protection. Have a look here.

The Protection of Personal Information Act (POPI) will help South Africans in terms of helping secure our private data, but only when it becomes effective.

|

|

Small and Medium-Sized Businesses: How to Stay Healthy and Profitable

|

Today getting an SME going is incredibly difficult as they face enormous red tape (FICA, getting loans, VAT registration and so on) and have difficulty getting access to money as financial institutions prefer funding large corporates where, for a similar amount of work, they earn higher fees.

Yet we should be doing everything we can to make SMEs sustainable as just under 50% of jobs in the economy are created by small business.

SMEs: 3 steps to staying in business

It is difficult for the new owner of a business to keep focused on what the business should be achieving. The early parts of a business just need so much work – hiring the right staff, setting up processes that will efficiently drive the business, attending to bankers’ and investors’ needs, dealing with unions, the list is endless.

- But it is incredibly important to allocate time to reviewing whether the business is on track, what the competition and market are doing and adjusting or tweaking your strategy.

- Secondly, all successful businesses need to grow and it is a fact that growth costs more money. As resources are scarce make sure you control expenditure tightly and carefully monitor your cash flows.

- Thirdly, you become a successful entrepreneur by having a unique idea or a different way of delivering your product or service. Make sure you keep innovating to stay one step ahead of your competitors.

What can we and Government do?

Beginning with Government, steps need to be taken to make it easier for small businesses to succeed such as following through with Government’s commitment to reduce red tape, considering extending tax concessions for up to five years (SMEs pay less than 20% of the corporate tax take) and looking at regional incentives like reduced rates, subsidised rentals etc.

On our side why not mentor young start-ups in the ways of business? Many young businesses, for example, don’t consider governance in their business and getting this off to a good start will help them in the long term.

These are the businesses that can solve our most pressing problem – unemployment. We should help them as much as possible.

|

|

Your Tax Deadlines for July, and Keep Your Car Allowance Logbook Up To Date!

|

There are no major deadlines this month.

Just a reminder for those on a car allowance to keep comprehensive logbooks as per SARS requirements of all your business trips. Without proof of your business travel, SARS will deny your travel claim.

There are stories that SARS will be tightening up on logbooks and may require more detailed business trip information, so ask your accountant to inform you if there are changes.

|

|

Note: Copyright in this publication and its contents vests in DotNews - see copyright notice below.

|

| |

|

|

|

|